The Group maintains a keen awareness of the impact our business activities have on the environment, and our basic policy is to contribute to conservation of the environmental on a global scale by promoting the development of technologies that enhance the productivity of resources and materials. Furthermore, as we execute business, we seek to reduce our environmental impact at every stage of the supply chain.

Assessment: Achieved/Steady Progress Not Achieved

| KPI | FY2022 Results/Progress | Assessment |

|---|---|---|

| Total in-house CO2 emissions: Promoting initiatives to achieve net zero CO2 emissions in FY2050 and 50% reduction in FY2030 (vs. FY2018) | We continued our activities through the Carbon Free Project, which was launched to achieve these targets, and promoted a variety of initiatives for decarbonization, including the introduction of CO2-free electricity at each of our sites and the creation of roadmaps per division toward net zero emissions. | |

| Increase percentage of recycled raw materials: Expand the breadth of recycled materials to be treated | We have been working to increase the percentage of recycled raw materials used in copper smelting (input ratio of raw materials or content ratio in products) to 50% or more by 2040 by expanding our facilities and by researching and testing new processes for better treatment of recycled materials and improving logistics efficiency. | |

| Landfill disposal rate: Less than 1% in FY2022 | We have set a goal of keeping our landfill disposal rate at no more than 1% in order to cut down on waste with the aim of minimizing our impact on the environment. Our landfill disposal rate in fiscal 2022 was 0.92%. |

The JX Metals Group views climate change as an urgent issue that must be resolved on a global scale, and in order to contribute to the resolution of this issue, we have set the ultimate goal of achieving net zero CO2 emissions and are further accelerating our efforts to achieve this goal.

In accordance with the TCFD’s recommendations, the Group will strive to proactively disclose information based on the disclosure framework of Governance, Risk Management, Metrics and Targets, and Strategy.

We will also take concrete measures to address climate change.

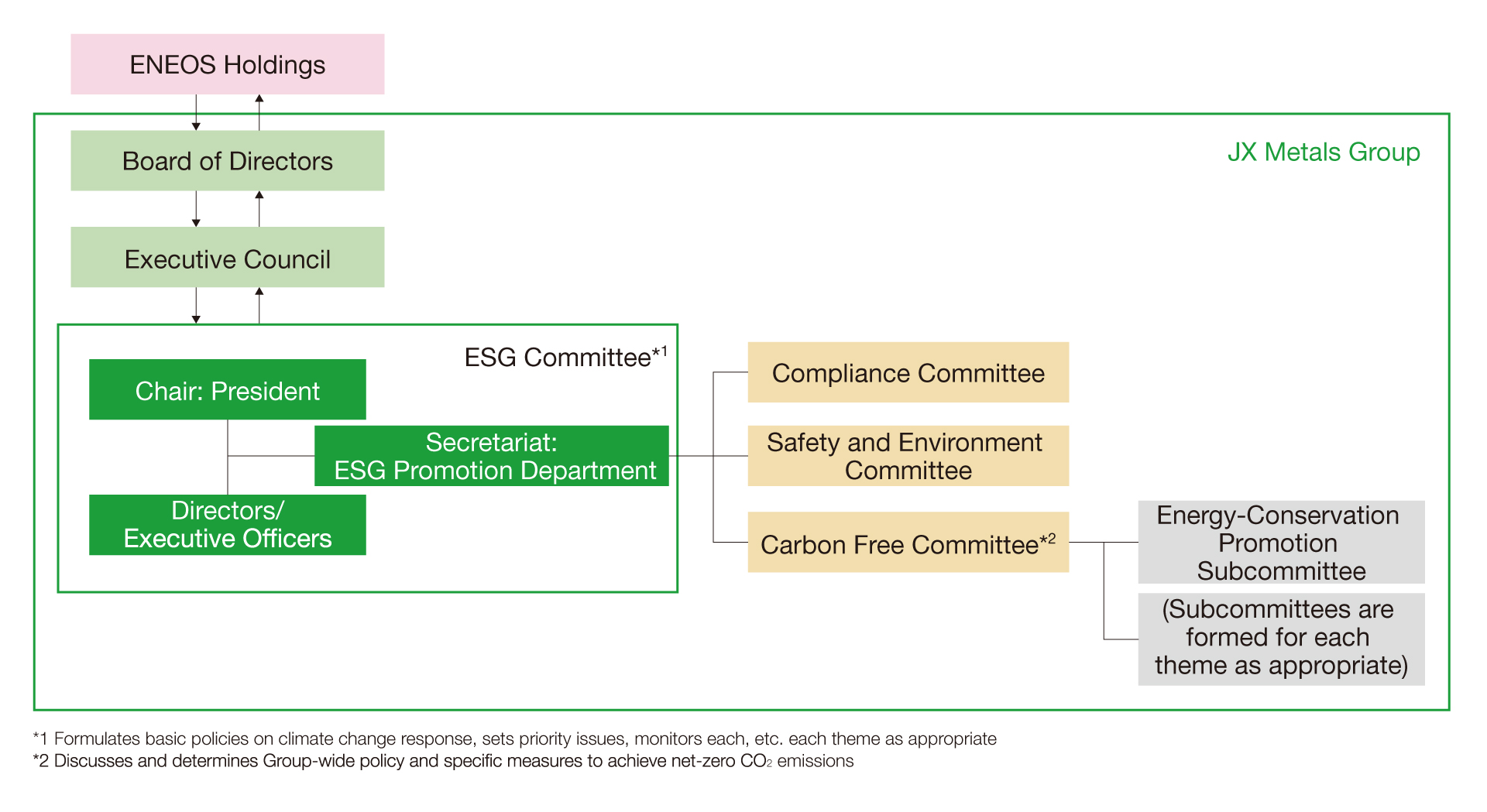

The ESG Committee, an advisory body to the president, is responsible for formulating basic policies regarding the Group’s response to climate change, setting priority targets, and monitoring these targets. The ESG Committee is chaired by the president of the Company, with members from the Executive Council and with participation by outside directors as observers. This committee meets twice a year in principle. Matters deliberated and decided are discussed at and reported to the Executive Council and the Board of Directors as appropriate, depending on the content.

At the Group, the ESG Promotion Department works with each department to assess and identify risks and opportunities related to climate change, including scenario analysis, in accordance with the framework of the TCFD recommendations. The department recently collected and analyzed information for scenario analysis on a wide range of risk factors associated with climate change impacts, including regulations and business impacts, and began to identify our own risks and opportunities related to climate change response, as well as medium- to long-term business strategy measures. The results of the analysis and the status of measure implementation are shared with management through the ESG Committee and other channels. Based on this, each department takes action in these areas in cooperation with the ESG Promotion Department.

The Group has established our in-house CO2 emissions (Scope 1 and 2) as an indicator of climate change and aims to achieve net-zero emissions by fiscal 2050. We have set an interim target of a 50% reduction by fiscal 2030 versus Scope 1 and 2 total in-house emissions in fiscal 2018, based on backcasting from our fiscal 2050 goal.

In identifying the risks and opportunities that climate change poses to our Group and businesses, and in considering strategies to address risks and capture opportunities, we referred to the World Energy Outlook (WEO) of the International Energy Agency (IEA), the New Policies Scenario (NPS) of the WEO 2018, the Sustainable Development Scenario (SDS) in light of the Paris Agreement, as well as the Net Zero Emissions by 2050 Scenario (NZE Scenario) published in 2021. Furthermore, our analysis adopts global warming scenarios (from RCP2.6 to RCP8.5) from the Fifth Assessment Report (released in 2014) of the United Nations Intergovernmental Panel on Climate Change (IPCC).

Assuming a transition to a decarbonized society in the wake of climate change, the Group’s businesses will play a major role in shifting the power generation mix to renewable energy sources, transforming power use in ways such as electrification, and achieving social implementation of the circular economy. Opportunities for increased product demand and the evolution of our offerings are also expected.

On the other hand, there are risks such as increased costs associated with the Group’s own efforts to become carbon neutral on a global basis and lost opportunities due to delays in this process. In addition, there are potentially increased physical risks of extreme weather events damaging production facilities and logistics networks at operating sites in Japan and overseas, resulting in shutdowns.

| Category | Impact | Risk/Opportunity | Measures |

|---|---|---|---|

| Transition Risks | Policies and Regulations | Increased costs to achieve net-zero CO2 emissions |

|

| Introduction and strengthening of carbon taxes, etc. in Japan and abroad |

|

||

| Reputation | Loss of opportunity due to delayed action toward decarbonization and environmental impact reduction |

|

|

| Physical Risks | Acute | Damage to facilities and shutdowns due to extreme weather events |

|

| Opportunities | Products | Increased demand for nonferrous metals needed for a decarbonized society (Base Businesses) |

|

| Increased demand for high-end electronic materials (Focus Businesses) |

|

||

| Circular economy | Realizing circular economy |

|

|

| Increased demand for and mandated recycling of automotive LiBs |

|

With the transition to a decarbonized and resource-recycling society, demand for nonferrous metals and advanced electronic materials related to our Group’s businesses is expected to grow, and we believe that the key point is how to realize capacity expansion, technology development, and partnership-building in order to meet this demand.

However, the results of the scenario analysis revealed the importance of smoothly transitioning the JX Metals Group to carbon neutrality and evolving our BCPs to mitigate physical risks associated with natural disasters and minimize their impact when they occur.

Electricity accounts for approximately 60% of our Group’s total CO2 emissions (Scope 1 and 2), and we are switching to CO2-free electricity at our major operating sites in Japan and overseas. We are also considering measures to generate renewable energy on our own and to address energy sources other than electricity used in our manufacturing processes.

Although additional costs are incurred in the necessary initiatives to achieve this, in the form of capital investment, R&D expenses, and the price difference (premium) between CO2-free electricity and traditional electricity, we will steadily move toward decarbonization through the use of transition financing, a first in the nonferrous metals industry, and by reducing costs through energy-conservation activities.

Carbon taxes are being considered for introduction in Japan and abroad. If these or other systems are introduced, there is a risk of cost increases based on CO2 emissions. If a carbon tax is introduced, the annual cost increase is expected to be approximately 5 billion yen*.

The Group has established a roadmap toward carbon neutrality and is steadily implementing various initiatives to reduce CO2 emissions, so the cost burden is expected to be relatively insignificant.

If CO2 emission reductions do not proceed according to the roadmap or if other environmental impacts increase, there is a risk that the Group may suffer harm to our social credibility. In addition, delays in responding to climate change-related requests from customers could result in reduced sales opportunities.

The Group pursues steady decarbonization initiatives and responds to individual customer requests. We also develop technologies and make capital investments to reduce our carbon footprint (CFP) and increase the percentage of recycled raw materials in accordance with the Sustainable Copper Vision . We are also building partnerships with external parties to achieve and disseminate the Sustainable Copper Vision.

Physical sorting technology for recycled materials

Extreme weather events, including intensifying typhoons, may cause damage to the Group’s various facilities at operating sites in Japan and overseas. In addition, damage to our supplier and logistics networks increase the risk that we cannot sustain normal operation.

The Group has conducted analyses using hazard maps and other data at our major operating sites in Japan and confirmed that the risk of damage from extreme weather events is low. In addition, we have established business continuity plans (BCPs), and conduct periodic training and reviews to promote the establishment of Business Continuity Management (BCM). We believe that these measures will keep the impact on our business to relatively minor levels even if the risk of damage to facilities or shutdowns due to extreme weather events materializes.

Needs for renewable energy and electrification of mobility are expected to grow significantly toward the realization of a decarbonized society, and copper and other nonferrous metals will be increasingly used in these areas. The JX Metals Group earned operating profit of approximately 18.7 billion yen in fiscal 2022 in the Mineral Resources Business and Metals & Recycling Business, and this growing demand is expected to provide opportunities for further sales and earnings growth for the Group. The Group is working to strengthen our business through portfolio reviews, and is taking various measures to increase the input recycling raw materials ratio and reduce our CFP in Green Hybrid Smelting, which utilizes both copper ore and recycled raw materials, in order to establish a stable supply system.

In addressing climate change, it is essential to significantly improve energy use efficiency using technologies such as IoT, AI, and 5G/6G. Many high-end electronic materials are used in these fields, and demand for these materials is expected to continue to grow. The Group maintains product families with high global market share in the area of electronic materials, including sputtering targets and treated rolled copper foil for FPC, and in fiscal 2022, related businesses generated approximately 56.4 billion yen in operating profit.

Currently, we are constructing several new plants and increasing capacity to meet strong demand. In addition, we are working to construct a new plant in Hitachinaka City, Ibaraki Prefecture, and in the U.S. in anticipation of further growth in demand. In addition to these capital investments, from a longer-term perspective, the Advanced Technology & Strategy Department is taking the lead in open innovation through industry-academia collaboration and investment in startups.

Illustration of the completed Hitachinaka New Plant (tentative name)

Though demand for copper will continue to grow over the long term as the world moves toward a decarbonized society, the supply of copper ore and recycled raw materials from existing mines is limited.

The Sustainable Copper Vision we have established aims to build a stable supply system to support growing copper demand through Green Hybrid Smelting that utilizes both copper ore and recycled raw materials. As one of our measures to evolve and gain wider use of sustainable coppers, we are working on technological development to increase the recycled raw materials ratio (input ratio of raw materials or content ratio in products) to 50% or more by 2040. To this end, it is essential to enhance our system for collecting and processing recycled raw materials. Here, we will not only strengthen the supply chain through capital investment and M&A, but also form Green Enabling Partnerships with companies, local governments, universities, and research institutions who work together to promote sustainable copper. Through these partnerships, we engage in product and scrap collection, raw materials reuse, and joint technology development.

Electric vehicles (EVs) are expected to become widespread as part of a decarbonized society. This will increase demand for lithium, cobalt, and nickel used in lithium-ion batteries (LiBs) in EVs. There are also concerns about geopolitical risks and rising resource nationalism surrounding these resources. Future large-scale disposal of LiBs is also expected, requiring their efficient recycling.

The Group is working to develop technologies, conduct demonstration trials, and establish a resource recycling system throughout the supply chain with the aim of realizing closed-loop recycling to extract the aforementioned metals from automotive LiBs reaching end of life (EoL) in as automotive battery materials.

Bench scale equipment for LiB recycling

Toward the goal of reducing our total in-house CO2 emissions in fiscal 2030 and fiscal 2050, we are working on four priority activities: (1) Introduction of CO2-free electricity, (2) Generation of renewable energy, (3) Promotion of zero energy loss activities, and (4) Fuel switching and technology development toward decarbonization.

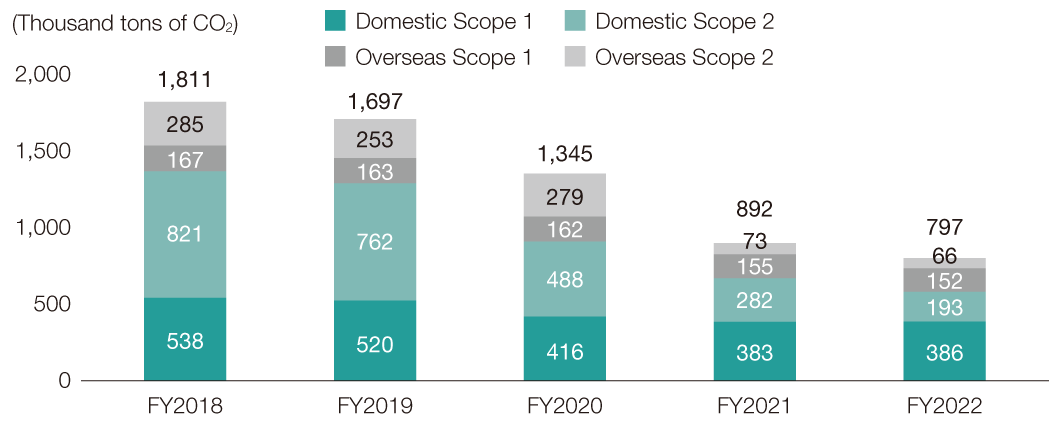

As a result, our in-house CO2 emissions in fiscal 2022 (total of Scope 1 and 2) were 797 thousand t-CO2.

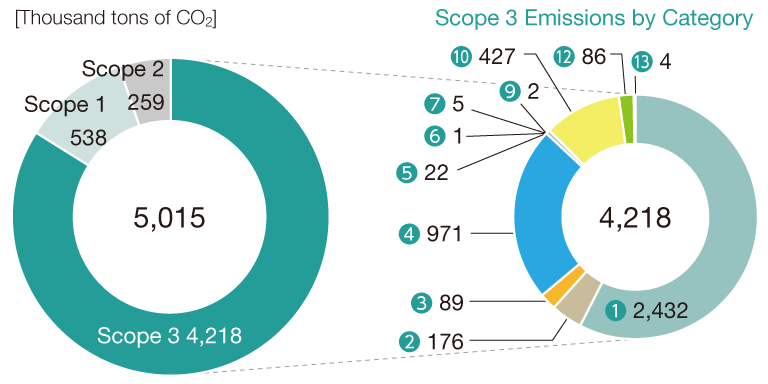

In addition to existing data for Scope 1 and 2 CO2 emissions, in fiscal 2021 the Group began calculating indirect Scope 3 emissions in order to determine the overall CO2 emissions generated by our operations and products. Through a Group-wide initiative centered on the Carbon Free Project, we calculated emissions results for each fiscal year while obtaining insights from outside experts. Going forward, we will study ways to improve calculation methods and accuracy for each category, as well as to establish and implement emission reduction targets.

Scope 1 and 2 emissions are calculated for operating sites of high quantitative importance. Scope 3 emissions are calculated mainly for operating sites where production activities are conducted, and the scope of calculation is different for each category. Categories ❽, ⓫, ⓮, and ⓯ were not calculated because the Group has no relevant activities in these areas.

❶Purchased goods and services ❷ Capital goods ❸ Fuel- and energy-related activities not included in Scope 1 or 2 ❹ Upstream transportation and distribution ❺ Waste generated in operations ❻ Business travel ❼ Employee commuting ❽ Upstream leased assets ❾ Downstream transportation and distribution ❿ Processing of sold products ⓫ Use of sold products ⓬ End-of-life treatment of sold products ⓭ Downstream leased assets ⓮ Franchises ⓯ Investments

In our assumptions for fiscal 2050, emissions are expected to increase due to business expansion over the course of time. In response to this, we aim to achieve net-zero total in-house emissions (Scope 1 and 2) in fiscal 2050 by combining energy conservation, purchase and in-house generation of renewable energy, electrification and fuel switching, process modification, and carbon capture and recycling*, centered on the four priority activities we have already launched.

Through our recycling business, specifically the evolution of Green Hybrid Smelting, and supply of advanced technological materials and products, we contribute to the reduction of CO2 emissions in society as a whole. We not only strive to reduce the Group’s CO2 emissions to net zero, but also to reduce the CO2 emissions of society as a whole.

Since approximately 60% of the Group’s in-house CO2 emissions come from electricity, we began introducing CO2-free electricity* in fiscal 2020. In fiscal 2022, the switch to CO2-free electricity was completed at all major operating sites in Japan, except for some sites with contractual restrictions. We are also gradually switching electricity at our operating sites outside Japan.

The JX Metals Group is engaged in generating our own renewable energy. To date, we have introduced hydroelectric, binary, and solar power generation facilities at our operating sites in Japan and overseas. In June 2022, our second on-site solar power generation facility using a PPA* began operation at the Isohara Works.

In April 2023, we implemented an off-site PPA model for the Kurami Works. This is the first time for the Group to adopt an off-site model outside a plant site. We expect power generation on the order of 9,000 kW (solar panel basis), making the system the largest off-site PPA solar power generation systems for a single business site in Japan. In addition to this solar off-site PPA model, we installed solar power generation equipment in the newly constructed R&D building at the Kurami Works to meet a portion of electricity needs.

Example of a solar power generation system installed by a PPA operator

| Site | Method | Generated |

|---|---|---|

| Kakinosawa Power Plant, JX Metals Corporation | Hydroelectric | 24,629 |

| Kakegawa Works, JX Metals Precision Technology Co., Ltd. | Solar | 2,351 |

| Isohara Works | Solar | 211 |

| Shimoda Hot Springs Co., Ltd. | Geothermal | 36 |

| Nikko Metals Taiwan Co., Ltd. | Solar | 205 |

| Nippon Mining & Metals (Suzhou) Co., Ltd. | Solar | 71 |

| JX Metals Korea Co., Ltd. | Solar | 112 |

| Materials Service Complex Coil Center (Thailand) Co., Ltd. | Solar | 14 |

As a Group that operates in an electricity-intensive industry, we have been promoting energy conservation activities at every stage of our business activities for some time. However, we believe it is now necessary to promote zero energy loss activities from new angles in order to achieve net-zero CO2 emissions. For example, we will take on the challenge of achieving zero energy loss by soliciting ideas from all Group employees, such as updating facilities with a focus on CO2 reduction that goes beyond cost reduction, and fundamentally reviewing facility operation methods.

In June 2023, we established the Manufacturing Technology Office in the Advanced Technology & Strategy Department under the Technology Group. This organization aims to optimize production processes across the JX Metals Group by sharing production technologies developed individually by each department. As part of these efforts, we pursue further energy conservation, the installation of waste heat recovery equipment, and other measures to reduce CO2 emissions across the Group.

In addition to electricity, our business processes use heavy oil, coke as a reducing agent, and other energy sources, and we are working to reduce CO2 emissions from these sources. One candidate to achieve this is fuel switching. In the industry, technologies are being developed for new fuels such as hydrogen and ammonia, and we will also consider the use of these fuels.

We established the Carbon Free Committee in fiscal 2022 as an organization to discuss and determine company-wide policies and specific measures toward net zero CO2 emissions. The committee is led by the ESG Promotion Department and membership includes executives from each business unit and production site, the Technology Group, and management from Group companies. Since its inception, the committee has been studying decarbonization and resource recycling measures that contribute to improving business competitiveness and added value from a company-wide and strategic perspective toward net zero CO2 emissions. These studies consider (1) The JX Metals Group Long-Term Vision and Medium-Term Management Plan for 2023-2025, (2) The Sustainable Copper Project, and (3) Social conditions, etc. Based on these considerations, the committee has decided to focus on the early adoption of carbon-neutral plants (net zero CO2 Scope 1 and Scope 2 production sites, and, particularly, a comprehensive reduction of fuel-derived CO2 emissions).

Currently, expectations are growing for transition-linked loan frameworks (TLL) to serve as a mechanism to support the implementation of long-term transition strategies by industries with significant GHG emissions, and rules are being developed in Japan and overseas to this end.

In June 2022, the JX Metals Group became the first in the Japanese nonferrous metals industry to develop a transition-linked loan framework (TLLF). This framework was developed with the support of Mizuho Bank, Ltd. and has acquired a third-party assessment regarding its applicability to various principles and guidelines, including the Basic Guidelines on Climate Transition Finance established by the Ministry of Economy, Trade and Industry, the Ministry of the Environment, and the Financial Services Agency. We have established two sustainable performance targets (SPTs) in our TLLF and linked the achievement of these SPTs to the interest rate terms of the TLL, thereby establishing a mechanism for us to commit to the implementation of our transition strategy.

Based on the framework we have formulated, the Company entered into a TLL agreement with Joyo Bank, Ltd. in June 2022. This is the first TLL project in the nonferrous industry in Japan, and will be used to cover the environmental costs of the New Hitachi-kita Factory (tentative name), a new production base for sputtering targets for semiconductors currently under construction in Hitachi City, Ibaraki Prefecture.

New Hitachi-kita Factory (tentative name)

The GX League, led by the Ministry of Economy, Trade and Industry (METI), is a framework for industry, government, and academia to collaborate in the challenge of Green Transformation (GX) with a view to achieving carbon neutrality by 2050 and reforming Japan’s entire economic and social system. We participate in GX activities, and we expressed our support for the GX League Basic Concept.

We announced our participation in Phase 1, covering fiscal 2023 to fiscal 2025. Phase 1 will include proof-of-concept tests and dialogues regarding three initiatives: (1) A platform for the future vision, (2) A platform for market creation and rulemaking, and (3) A platform for carbon credit exchange. JX Metals will participate actively in discussions and information exchange toward the achievement of GX.

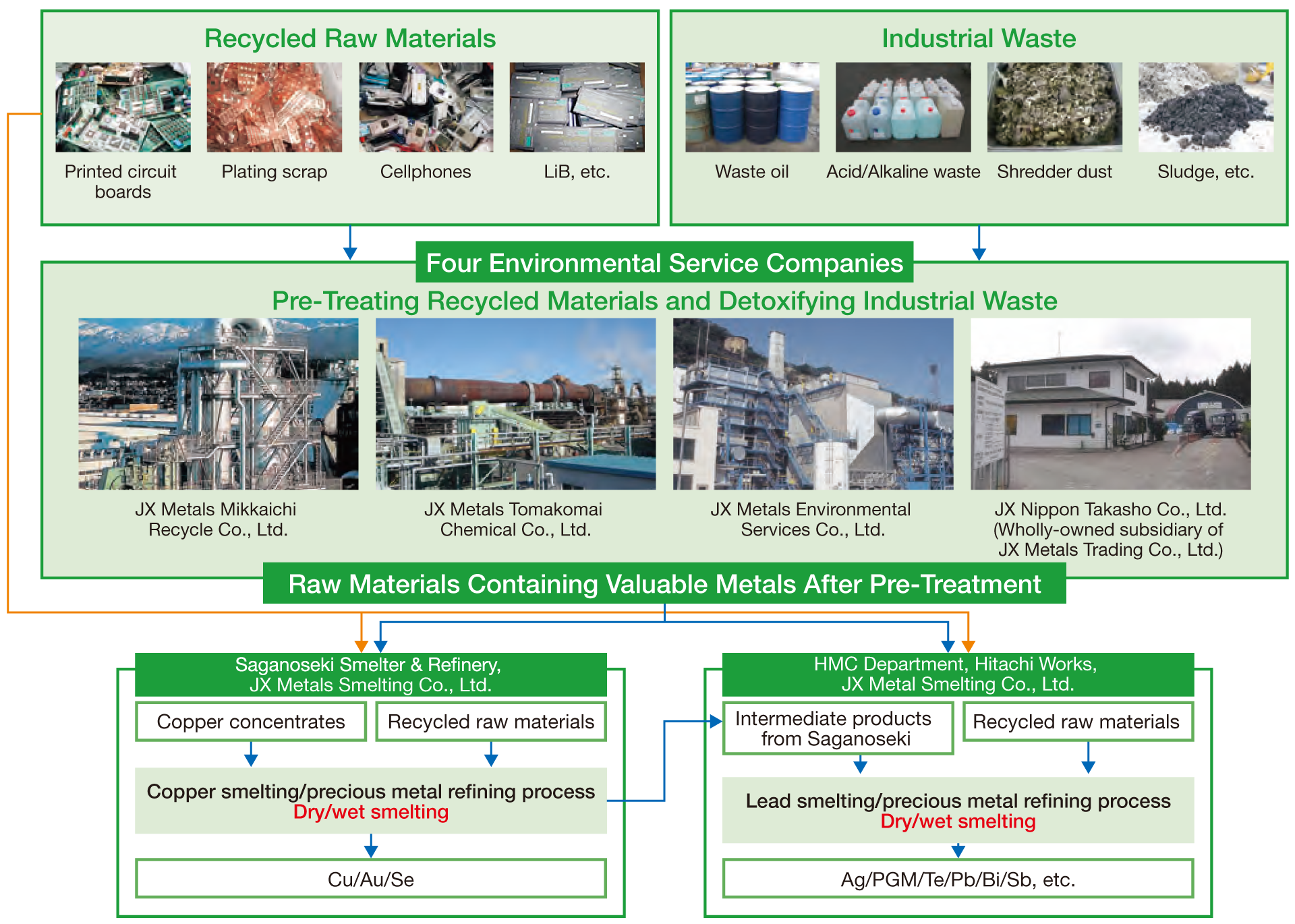

At the Group, we recognize that the mission of players involved in the materials industry is to minimize resource final disposal through an ongoing cycle while maintaining the maximum value of these resources. Based on this concept, we aim to achieve a circular economy.

Minor metals such as nickel, cobalt, and lithium used in LiB are not produced in Japan, but are rather concentrated in a specific set of countries and regions. Reducing the environmental impact and supply chain risk associated with the use and securing of these mineral resources has become a serious social issue.

In 2020, we established a closed-loop recycling process to recover minor metals from end-of-life automotive LiBs, reusing these metals as raw materials for automotive LiBs in continuous processing bench-scale test equipment installed at Hitachi Works. A scaled-up version of the process is in place at JX Metals Circular Solutions Co., Ltd. (Tsuruga, Japan), and we are performing proof-of-concept test operations. In addition to the operation of a high-purity nickel sulfate recovery facility (launched in 2021) and a high-purity cobalt sulfate recovery facility (2022), we began operations of a high-purity lithium carbonate recovery facility in April 2023. In the future, we will provide high-purity recycled metal salts to the supply chain for tests of closed-loop recycling.

Bench-scale equipment at Hitachi Works

To demonstrate the closed-loop recycling of automotive LiB using our process in the German government-supported HVBaTCycle Consortium (adopted in 2022), we built a bench-scale plant similar to Hitachi on the TANIOBIS yard (Goslar), which began operations in March 2023. Using the black mass (cathode active material powder recovered from discarded batteries) provided by Volkswagen, we work with project partners to optimize the process.

In April 2022, the New Energy and Industrial Technology Development Organization (NEDO) adopted our project for the Development of Technology for Closed-Loop Recycling for Automotive LiB for their Green Innovation Fund. Utilizing this fund in cooperation with academia, we are conducting the following studies according to schedule: (1) Establishment of a life cycle assessment (LCA) evaluation method for LiB recycling, (2) Advancement of metal recovery technology using hydro-metallurgical processing, and (3) Advancement of metal recovery technology in the detoxification pretreatment process.

Our Smelting, Refining, and Recycling Business generally buries secondary waste (incinerated ash, incineration residue, etc.) generated during the treatment of industrial waste as the final method of disposal.

Pursuing the notion of never discard, never bury, the JX Metals Group strives for zero emissions by combining our environmental and recycling businesses to build and operate a system to recycle these secondary wastes and the valuable metals contained therein. Affiliated companies involved in our Environmental Business work with the Metals and Recycling Business sites to achieve a recycling-oriented society.

Click to enlarge

The Group recognizes that biodiversity conservation is an important management issue. Mining operations, in particular, interact closely with local ecosystems. This interaction requires careful consideration, and we carry out various initiatives as appropriate.

Using the Integrated Biodiversity Assessment Tool (IBAT), we surveyed a 5-kilometer radius around each of our six sites in Japan to determine whether protected areas exist in the vicinity of our sites. Our assessment revealed no areas identified as strict nature reserve, wilderness areas, national parks, or natural monument or feature (Ia, Ib, II, III: See the table to the right).

| Category Ia Category Ib |

Strict nature reserve Wilderness area |

Protected areas managed primarily for the purpose of academic research or wilderness conservation |

|---|---|---|

| Category II | National park | Areas managed primarily for ecological protection and recreation |

| Category III | Natural monument or feature | Areas managed primarily for the protection of special natural phenomena |

| Category IV | Habitat/species management area | Areas managed primarily for conservation through human management |

| Category V | Protected landscape or seascape | Areas managed primarily for landscape protection and recreation |

| Category VI | Protected area with sustainable use of natural resources | Areas managed primarily for the sustainable use of natural ecosystems |

Since our founding in 1905, the JX Metals Group has been engaged in mining operations across Japan. By ensuring a steady supply of nonferrous metals and other resources, we contributed to Japan’s economic growth. In Japan, however, operations have ceased in nearly all mines as their mineral resources have dried up. Still, in closed mines, we provide acid mine drainage (AMD) treatment and work to maintain and preserve the natural environment.

JX Nippon Mining Ecomanagement, Inc. oversees the closed mines managed by the Company. The work mainly consists of detoxifying acid mine drainage (AMD) and maintaining and preserving the tailings dams and galleries of the mining sites. AMD occurs when rainwater or other water comes into contact with materials such as copper concentrates remaining after the mine is closed or the rubble and slag of tailings dams. Since AMD contains metals and is highly acidic, treatment facilities have to operate 365 days a year. As for tailings dams, construction is underway to handle the recent flooding in areas of frequent rainfall and to adapt to large earthquakes. Through the management of these closed mines, we are striving to preserve the natural environment.

The drainage canal of the Toyoha Mine Ishiyama tailings dam, completed in FY2022

The Group has been promoting reforestation activities throughout Japan, especially at the sites of closed mines. Employees and their families participate in these activities to communicate the importance of protecting the local environment through contact with nature.

The 16th Mt. Kurakakeyama Cherry Blossom Mountain Development and Maintenance Activity was held. A total of 26 Company volunteers from the Hitachi area participated, including the general manager. Other companies, civic groups, and neighborhood residents in Hitachi City participated, bringing the total number of participants to about 150.

In the Taisho and Showa periods, Hitachi Mine workers planted as many as 10 million trees in the area. As a result, many cherry trees have grown wild in Hitachi City. The development and maintenance activity has been organized by Hitachi City since 2008 to create a mountain and cherry blossoms for future generations over the next 100 years. This was the first time in four years that the city held the activity. On the day of the event, under clear, sunny skies, participants were divided into groups, working hard at clearing fallen trees, cutting underbrush, and pruning branches. After about an hour of work, participants received rice ball lunch boxes from Hitachi City. The local JX Metals office donated apples from Daigo Town. One participant commented that they looked forward to seeing the cherry blossoms next year.

Participant group photo

General Manager Suzuki was interviewed by cable TV station JWAY

JX Metals volunteers pruned and cleared brush

In the Group’s business activities, we use large quantities of water in our copper mining operations, as well as for cooling water (mainly seawater) used in smelters. We recognize that water resources are not only essential for our Group’s business activities, but also important resources for the local communities where our production sites are located. With this in mind, we are doing our best to make sure that these sites make effective use of water resources by properly monitoring water consumption and exploring methods for reduced use or reuse.

Each manufacturing site monitors its own emission standards, which are stricter than the legally mandated standards. In addition, each site manages operations appropriately to ensure emission standards are not exceeded.

The Group assesses and confirms how water risks, such as water shortages, water pollution, and flooding associated with climate change, affect each production site. We use Aqueduct Water Risk Atlas, a water risk assessment tool provided by the World Resources Institute (WRI), to identify what water risks are present.

In fiscal 2022, we assessed six of our main production sites in Japan. None of the sites were found to have high water risk in the assessment.

The Group has voluntarily established chemical substance management standards, and we strive to mitigate the harmfulness of these substances by controlling their use. In addition, the Green Procurement Guidelines clearly identify substances that must not be included in manufacturing processes, materials, or equipment, and we ensure our suppliers are aware of these. Furthermore, we strive to provide safety information to our customers and all other product stakeholders.

The Group contributes to environmental conservation by detoxifying hazardous waste through our treatment businesses for low-concentration PCBs and asbestos. In 2014, JX Metals Tomakomai Chemical Co., Ltd. became the first firm in Hokkaido to receive certification from the Minister of the Environment as a detoxification facility for treating low-concentration PCB waste. In addition, JX Metals Environmental Services Co., Ltd. is engaged in the melting and detoxification of asbestos. The company treated approximately 2,800 tons of waste asbestos in fiscal 2022.

We are also proceeding with treatment of Group-owned equipment with high-concentration PCBs at the Japan Environmental Storage & Safety Corporation (JESCO). We plan to complete the treatment of this equipment by the prescribed disposal deadline. In addition, we are planning the disposal of equipment with low-concentration PCBs through licensed low-concentration PCB treatment contractors such as JX Metals Tomakomai Chemical Co., Ltd.; this disposal is scheduled to be completed by fiscal 2024, two years before the disposal deadline.

Rotary kiln incinerator at JX Metals Tomakomai Chemical Co., Ltd.

As a comprehensive manufacturer of nonferrous metals and advanced materials, the JX Metals Group is rising to the challenge of innovation in the productivity of resources and materials. Committed to compliance with environmental regulations, we carry out the following initiatives in order to proactively strive for environmental conservation on a global scale, including measures against global warming, and contribute to building a sustainable society.

Through steady operation of environmental management systems, the Group works to ensure compliance with environmental laws and regulations. The Environment & Safety Department at the Head Office monitors and supervises the state of compliance and reports to the ESG Committee through the Safety and Environment Committee. At their annual meeting, environmental management supervisors work to strengthen our compliance system by providing information on legal and regulatory trends and reporting on the status of compliance at each operating site. We additionally reinforce employees’ knowledge of laws and regulations by holding rank-specific education and training regularly at the Head Office and operating sites.

In fiscal 2022, there were no adverse dispositions from regulatory authorities (including license revocation, orders to cease operations, orders to cease use of facilities, orders for improvement, fines, etc.) for violations of environmental laws and regulations.

The JX Metals Group has established environmental management systems in line with ISO 14001 standards for ensuring achievement of the Action Plan for Environmental Protection, which was drawn up to reflect the Basic Environmental Policy. A multilevel organizational structure has been created, including various committees and subcommittees, in which everyone, from senior management headed by the president to employees at operating sites and affiliated companies, works together to promote environmental conservation and mitigate environmental risk. No environmental accidents occurred in the Group in fiscal 2022.

Individual operating sites implement internal environmental audits at least once a year. In addition, they periodically undergo environmental and safety audits by the Environment & Safety Department of the Head Office. Audits were conducted at 19 business sites in fiscal 2022.

Activities in the areas of health and safety and environmental conservation are planned, promoted, and reviewed by the Safety and Environment Committee, an organization under the ESG Committee. The Safety and Environment Committee meets once every six months.

An environmental & safety audit at Isohara Works

The Group has set a Green Purchasing Policy, aimed at reducing environmental and other social impacts when procuring materials and equipment. Based on this policy, we have drawn up Green Purchasing Guidelines setting out specific requirements for choosing suppliers. These guidelines contain requirements with which we ask our business partners to comply. These conditions apply to all suppliers.

We confirm supplier compliance with these guidelines through our CSR Procurement Questionnaire survey. In fiscal 2022, 85% of suppliers responded to our survey.