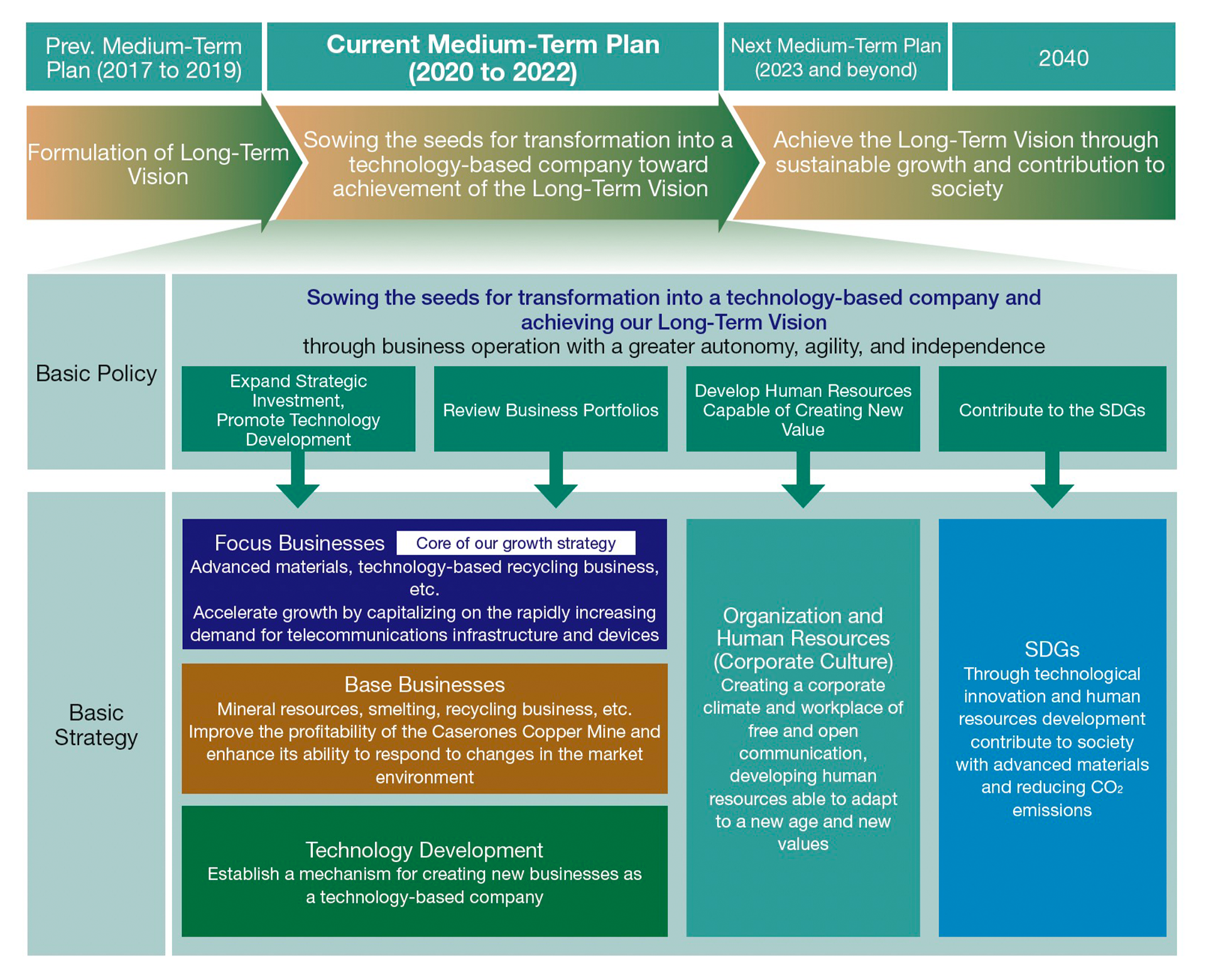

Beginning in fiscal 2020, the medium-term management plan is positioned as a three-year period for sowing seeds in anticipation of transforming into a technology-based company as set forth in the JX Nippon Mining & Metals Group Long-Term Vision 2040 formulated in May 2019. We are accelerating our efforts in new growth areas. We are promoting initiatives, human resource development, and the creation of an organizational culture suited to the characteristics of each business. We are implementing corporate management that further enhances autonomy, agility, and independence.

By pivoting from being an equipment industry company to a technology-based company, we will realize a highly profitable structure even in the face of intensifying international competition and contribute to the realization of a sustainable society as targeted by the SDGs

Click to enlarge

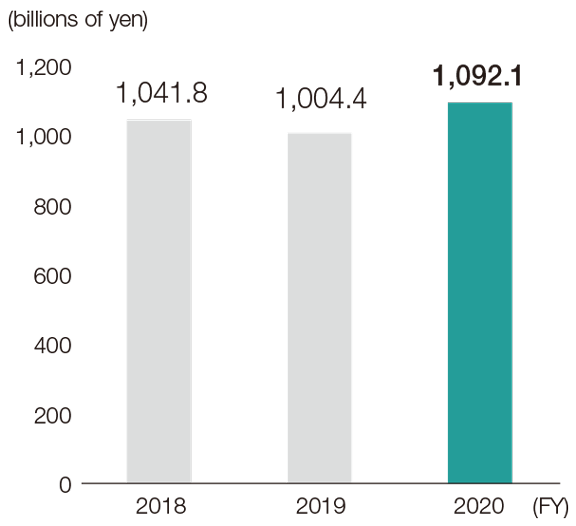

In the beginning of fiscal 2020, the global economy deteriorated rapidly due to the impact of the spread of COVID-19. Following that, there were signs of a recovery due to the supportive measures taken by various countries and the gradual resumption of economic activities. However, in the second half of the fiscal year, the impact of COVID-19 hit again, and a full-scale recovery was not achieved.

Copper prices temporarily fell due to concerns of a recession caused by the spread of COVID-19. Demand for refined copper however later recovered in China, while supply from copper mines in South America decreased. As a result, the starting price per pound rose from 216 cents to 401 cents at the end of the period.

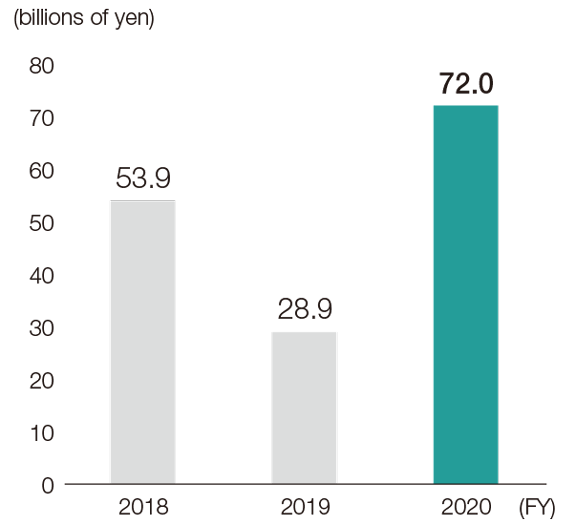

Under this business environment, the Group continued business activities by taking thorough measures to prevent the spread of infection. Operations at the Caserones Copper Mine also continued with the implementation of measures to prevent the spread of infection. However, due to delays in mining, the production volume decreased compared to the previous year. On the other hand, the sales volume of each product in the Functional Materials Business and Thin Film Materials Business generally exceeded the previous fiscal year. This was mainly due to an increase in demand in the high-functional IT field, including smartphones, servers, and telecommunications infrastructure due to the increase in telework.

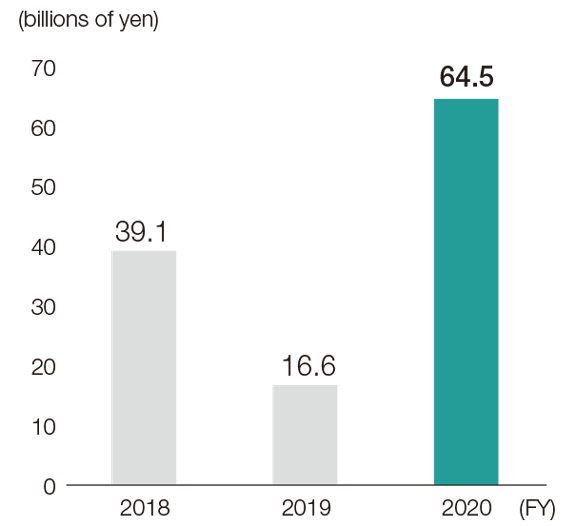

As a result, operating profit for the current fiscal year was 78.1 billion yen. This was mainly due to higher copper prices and increased sales of functional materials and thin film materials, despite the impact of lower production at the Caserones Copper Mine.

Revenue

Operating Profit

* Includes impact from inventory.

Profit before Tax

Net Income Attributable to Owners of Parent

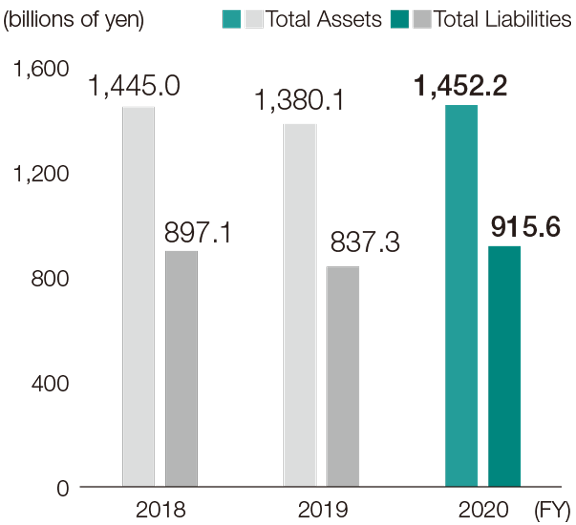

Total Assets and Total Liabilities

With significant changes in social trends, the Group formulated a Long-Term Vision out of a sense of crisis about continuing with our conventional business model. We are now aiming at transforming ourselves into a technology-based company. In particular, fiscal 2020 saw changes in the industry structure due to the impact of the spread of COVID-19, growing momentum toward SDGs and ESG management, and accelerated movement toward social demands for carbon neutrality. The environment surrounding the Group is changing even more drastically. By clearly understanding these social changes, we aim to fundamentally Change our organizational culture.

Creating the Long-Term Vision

| Expanding Needs for Advanced Materials | In addition to IT and mobility, digital data is being used in a variety of industries, including healthcare, energy, and construction. The need for advanced materials used in these fields will further expand |

| Shrinking Domestic Market/Focus on Emerging Economies for Sustainable Growth are Issues | The domestic market is shrinking due to the declining birthrate, aging population, and the industry hollowing out. The focus of economic growth is shifting to emerging economies in Asia and other regions, but the challenge is to deal with the environmental problems that are beginning to emerge even in emerging economies |

| Increasing Scarcity and Depletion of Resources due to the Expansion of the Middle Class | As the middle class increases, the amount of resources consumed also increases Acquiring good quality and inexpensive resources will be subject to competition. Resource shortages and depletion, as well as uneven regional distribution, will become more serious |

At Present

| Expanding Needs for Advanced Materials |

|

| Accelerating the Global Response to Climate Change |

|

| Growing Scarcity and Depletion of Resources |

|

When we formulated the current medium-term management plan, we set the operating income target at 170 billion yen for the three-year cumulative period. However, against the backdrop of the aforementioned business environment, we expect to increase profits in both Focused and Base Businesses. In the Focus Businesses, we increased our sales target by 15 billion yen from the original target set in the medium-term plan due to increased sales resulting from strong demand growth. Excluding the impact of the copper price hike and the spread of COVID-19, we expect Base Businesses to post higher earnings than planned at the time of formulating the medium-term plan. Based on this outlook, we will continue to make company-wide efforts to establish earnings and a financial base. In addition, we will promote the use of ESG-related indicators as important management indicators.

Operating Profit

| Results for Fiscal 2020 |

Outlook for Fiscal 2021 |

2020-2022 Three-year Cumulative Total |

||

|---|---|---|---|---|

| Focus Businesses | Functional Materials Business, Thin Film Materials Business, Other |

31.1 | 36.0 | 115.0 |

| Base Businesses | Mineral Resources Business | 34.9 | 32.0 | 187.0 |

| Metals & Recycling Business | 27.3 | 18.0 | ||

| Common Business Expenses | (15.2) | (26.0) | (52.0) | |

| Total | 78.1 | 60.0 | 250.0 | |

* The outlook for Fiscal 2021 and the three-year cumulative outlook are as of May 2021.

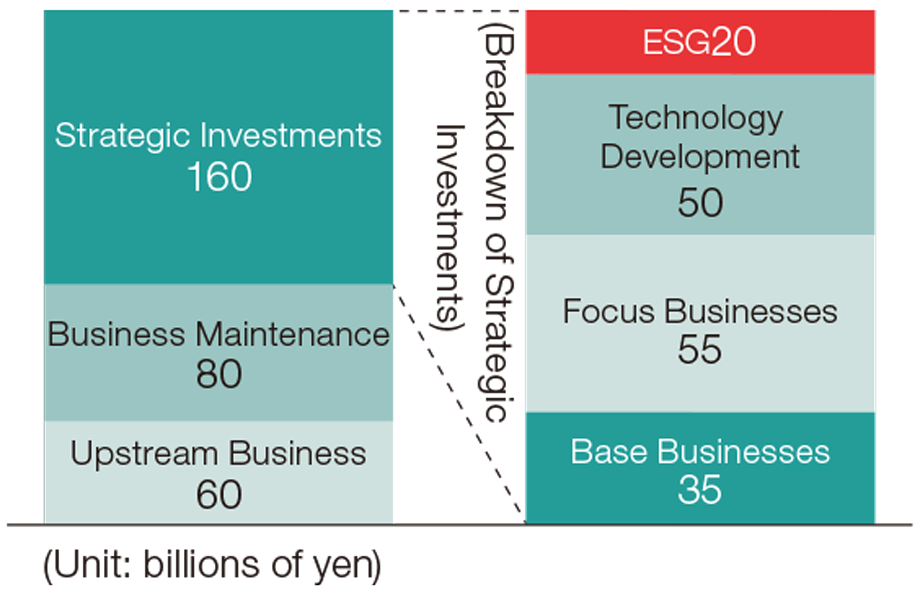

In the medium-term plan for fiscal 2020 - 2022, we will invest 300 billion yen over the three years in the development of advanced materials. Of this amount, 160 billion yen will be allocated to strategic investments for future growth, including capacity expansion, development of new materials, and exploration of rare metal mining interests. In addition, we will redefine our ESG investment quota of 20 billion yen to stimulate ESG activities such as decarbonization and resource recycling.

Cumulative Total of Investment Plan for Three years: 300 billion yen

| Focus Businesses |

|

|

| Base Businesses |

|

|

| Technology Development |

|

|

| ESG Management |

|

|

| Human Resource Development |

|