With the adoption of the Paris Agreement in 2015, efforts to achieve a decarbonized society are gaining momentum on a global scale. At the JX Nippon Mining & Metals Group, we recognize that addressing climate change risk is a top priority management issue and are taking steps to that end.

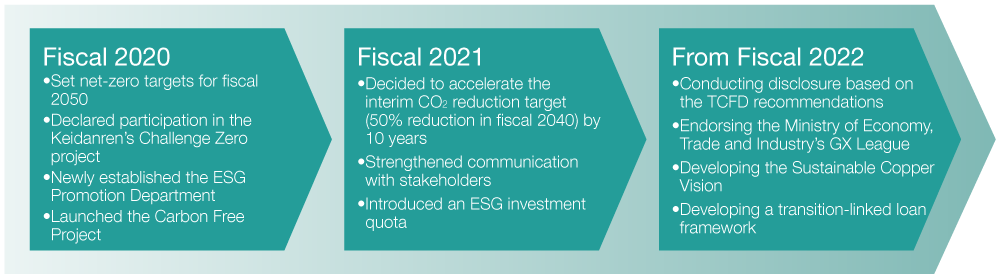

The Group has made environmental protection part of its corporate DNA since its founding, including when it rectified smoke pollution from the Hitachi Mine by constructing a large chimney stack, and in recent years has worked to continuously improve its environmental performance, including with respect to climate change. In 2020, we were among the first to participate in the Keidanren’s Challenge Zero decarbonization project, and in July of the same year, we set the goal to reduce total in-house CO₂ emissions by 50% in fiscal 2004 versus fiscal 2018, achieve net zero by fiscal 2050. Furthermore, in May 2021, in order to become a leading ESG company in the nonferrous metals industry, we decided to bring forward our interim target of 50% reduction to fiscal 2030, in recognition that our reduction rates must be comparable on a global level. All of us at the Group are working to achieve these targets.

Reduce total in-house CO₂ emissions by 50% in fiscal 2030 versus fiscal 2018, achieve net zero by fiscal 2050

In January 2021, as part of our efforts to achieve the aforementioned decarbonization vision, we launched the Carbon Free Project, a more than 60-member team led by members of the ESG Promotion Department, the Facilities Engineering Department, and the Procurement Department. Through this project, we have accelerated our efforts to realize a decarbonized society by formulating a roadmap toward net zero emissions in fiscal 2050 and studying specific reduction measures. In addition, we have now examined our awareness of climate change risks and opportunities, as well as our medium- and long-term measures and strategies to address them, and have decided to disclose these in our Sustainability Report.

In accordance with the TCFD’s recommendations, the Group will strive to proactively disclose information based on the disclosure framework of Governance, Risk Management, Metrics and Targets, and Strategy. We will also take concrete measures to address climate change.

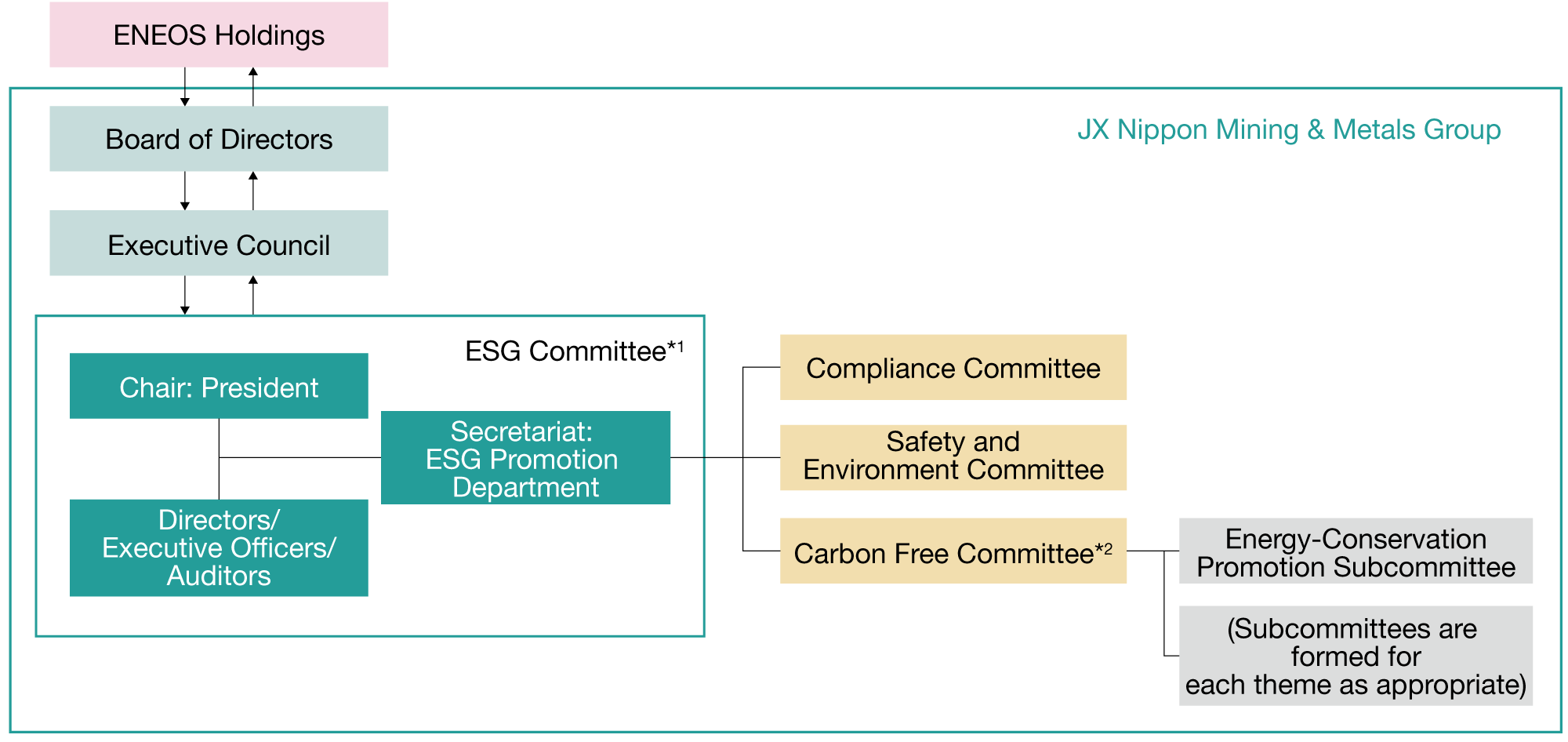

The ESG Committee, an advisory body to the president, is responsible for formulating basic policies regarding the Group’s response to climate change, setting priority targets, and monitoring these targets. The ESG Committee is chaired by the president of the Company, with members from the Executive Council and with participation by outside directors as observers. This committee meets twice a year in principle. Matters deliberated and decided are discussed at and reported to the Executive Council and the Board of Directors as appropriate, depending on the content.

At the Group, the ESG Promotion Department works with each department to assess and identify risks and opportunities related to climate change, including scenario analysis, in accordance with the framework of the TCFD recommendations. The department recently collected and analyzed information on a wide range of risk factors associated with climate change impacts, including regulations and business impacts, and began to identify our own risks and opportunities related to climate change response, as well as medium- to long-term business strategy measures.

The results of scenario analysis and the status of measure implementation are shared with management through the ESG Committee and other channels. Based on this, each department takes action in these areas in cooperation with the ESG Promotion Department.

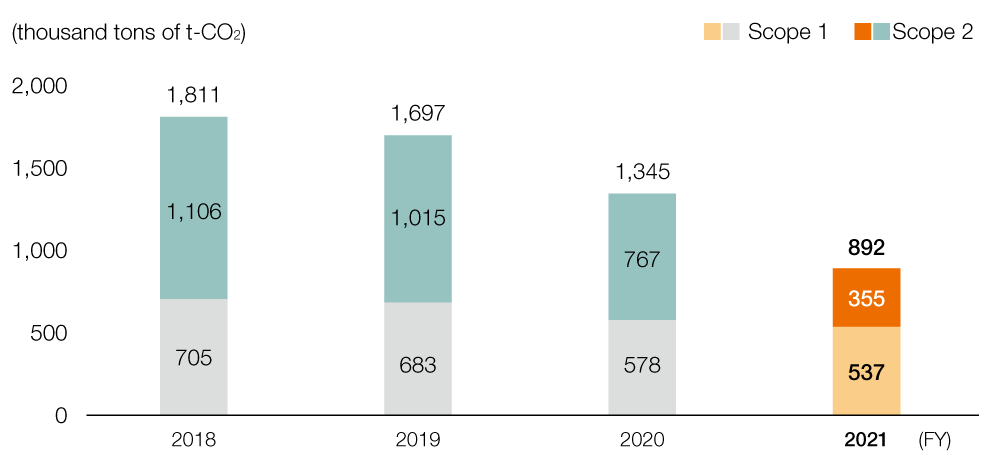

The Group has established its in-house CO₂ emissions (Scope 1 and 2) as an indicator of climate change and aims to achieve net-zero emissions by fiscal 2050. We have set an interim target of a 50% reduction by fiscal 2030 versus Scope 1 and 2 total in-house emissions in fiscal 2018, based on backcasting from our fiscal 2050 goal.

In identifying the risks and opportunities that climate change poses to our Group and its businesses, and in considering strategies to address risks and capture opportunities, we referred to the World Energy Outlook (WEO) of the International Energy Agency (IEA), the New Policies Scenario (NPS) of the WEO 2018, the Sustainable Development Scenario (SDS) in light of the Paris Agreement, as well as the Net Zero Emissions by 2050 Scenario (NZE Scenario) published in 2021. Furthermore, our analysis adopts global warming scenarios (from RCP2.6 to RCP8.5) from the Fifth Assessment Report (released in 2014) of the United Nations Intergovernmental Panel on Climate Change (IPCC).

Assuming a transition to a decarbonized society in the wake of climate change, the Group’s businesses will play a major role in shifting the power generation mix to renewable energy sources, transforming power use in ways such as electrification, and achieving social implementation of the circular economy, and opportunities for increased product demand and evolution of our offerings are expected.

On the other hand, there are risks such as increased costs associated with the Group’s own efforts to become carbon neutral on a global basis and lost opportunities due to delays in this process. In addition, there are potentially increased physical risks of extreme weather events damaging production facilities and logistics networks at operating sites in Japan and overseas, resulting in shutdowns.

| Category | Impact | Risk/Opportunity | Measures |

|---|---|---|---|

| Transition Risks | Policies and Regulations | Increased costs to achieve net-zero CO₂ emissions | Reducing costs through the use of transition finance, energy-conservation activities, etc. |

| Introduction and strengthening of carbon taxes, etc. in Japan and abroad | Conversion to electricity derived from renewable energy sources, conversion to low-carbon footprint (low-CFP) and/or decarbonized fuels, and creating innovation and improvements in manufacturing processes | ||

| Reputation | Loss of opportunity due to delayed action toward decarbonization and environmental impact reduction | Developing technology and making capital investments for decarbonization and reduction of environmental impact Disseminating and achieving the Sustainable Copper Vision through the formation of cross-industry partnerships (see page 26) |

|

| Physical Risks | Acute | Damage to facilities and shutdowns due to extreme weather events | Enhancement of our business continuity plans (BCPs) and regular training Establishing a Business Continuity Management (BCM) |

| Opportunities | Products | Increased demand for nonferrous metals needed for a decarbonized society (Base Businesses) | Making businesses more resilient through portfolio review Establishing a stable supply system through the evolution of Green Hybrid Smelting (see page 24) |

| Increased demand for high-end electronic materials (Focus Businesses) | Making capital investments to meet demand Engaging in open innovation through industry-academia collaboration and investment in startups |

||

| Circular economy | Realizing circular economy | Making efforts to evolve Green Hybrid Smelting by increasing the recycling raw materials ratio (see page 24) Evolving sustainable copper through the formation of cross-industry partnerships (see page 26) |

|

| Increased demand for and mandated recycling of automotive LiBs | Developing technologies, making capital investments, and engaging in industry-academia-government collaborations for closed-loop recycling of LiBs |

With the transition to a decarbonized and resource-recycling society, demand for nonferrous metals and advanced electronic materials related to our Group’s businesses is expected to grow, and we believe that the key point is how to realize capacity expansion, technology development, and partnership building in order to meet this demand.

However, the results of the scenario analysis revealed the importance of smoothly transitioning the JX Nippon Mining & Metals Group to carbon neutrality and of evolving our BCPs to mitigate physical risks associated with natural disasters and minimize their impact when they occur.

Electricity accounts for approximately 60% of our Group’s CO₂ emissions (Scope 1 and 2), and we are switching to CO₂-free electricity at our major operating sites in Japan and overseas. We are also considering measures to generate renewable energy on our own and to ad-dress energy sources other than electricity used in our manufacturing processes.

Although additional costs are incurred in the necessary initiatives to achieve this, in the form of capital investment, R&D expenses, and the price difference (premium) between CO₂-free electricity and traditional electricity, we will steadily move toward decarbonization through the use of transition financing, a first in the nonferrous metals industry, and by reducing costs through energy-conservation activities.

Caserones Copper Mine (switched to CO₂-free electricity in January 2021)

Carbon taxes are being considered for introduction in Japan and abroad. If these or other systems are introduced, there is a risk of cost increases based on CO₂ emissions. If a carbon tax is introduced, the annual cost increase is expected to be approximately 5 billion yen*.

The Group has established a roadmap toward carbon neutrality and is steadily implementing various initiatives to reduce CO₂ emissions, so the cost burden is expected to be relatively insignificant.

If CO₂ emission reductions do not proceed according to the roadmap or if other environmental impact increases, there is a risk that the Group may suffer harm to its social credibility. In addition, delays in responding to climate change-related requests from customers could result in reduced sales opportunities.

The Group is not only steadily promoting decarbonization initiatives and responding to individual customer requests, but it is also working to develop technologies and make capital investments to reduce its carbon footprint (CFP) and increase the percentage of recycled raw materials in accordance with the Sustainable Copper Vision (see page 23). We are also building partnerships with external parties to achieve and disseminate the Sustainable Copper Vision.

Physical sorting technology for recycled materials

Extreme weather events, including intensifying typhoons, may cause damage to the Group’s various facilities at operating sites in Japan and overseas. In addition, damage to our supplier and logistics networks increase the risk that we cannot sustain normal operation.

The Group has conducted analyses using hazard maps and other data at its major operating sites in Japan and confirmed that the risk of damage from extreme weather events is low. In addition, we have established business continuity plans (BCPs), and conduct periodical training and reviews to promote the establishment of Business Continuity Management (BCM). We believe that these measures will keep the impact on our business to relatively minor levels even if the risk of damage to facilities or shutdowns due to extreme weather events materializes.

Needs for renewable energy and electrification of mobility are expected to grow significantly toward the realization of a decarbonized society, and copper and other nonferrous metals will be increasingly used in these areas.

JX Nippon Mining & Metals Group earned operating profit of approximately 113.1 billion yen in fiscal 2021 in the Mineral Resources Business and Metals & Recycling Business, and this growing demand is expected to provide opportunities for further sales and earnings growth for the Group. The Group is working to strengthen its business through portfolio reviews, and is taking various measures to increase the input recycling raw materials ratio and reduce its CFP in Green Hybrid Smelting, which utilizes both copper ore and recycled raw materials, in order to establish a stable supply system.

In addressing climate change, it is essential to significantly improve energy use efficiency using technologies such as IoT, AI, and 5G/6G. Many high-end electronic materials are used in these fields, and demand for these materials is expected to continue to grow. The Group maintains product families with high global market share in the area of electronic materials, including sputtering targets and treated rolled copper foil for FPC, and in fiscal 2021 related businesses generated approximately 54.5 billion yen in operating profit.

Currently, we are constructing several new plants and increasing capacity to meet strong demand (see page 62). In addition, we are working to construct a new plant in Hitachinaka City, Ibaraki Prefecture (see page 71) and acquire a large site in the United States (see page 62) in anticipation of further growth in demand.

In addition to these capital investments, from a longer-term perspective, the Advanced Technology & Strategy Department is taking the lead in open innovation through industry-academia collaboration and investment in startups (see page 64 for specific examples).

Illustration of the completed Hitachinaka New Plant (tentative name)

Though demand for copper will continue to grow over the long term as the world moves toward a decarbonized society, the supply of copper ore and recycled raw materials from existing mines is limited.

The Sustainable Copper Vision we have established aims to build a stable supply system to support growing copper demand through Green Hybrid Smelting that utilizes both copper ore and recycled raw materials. As one of our measures to evolve and gain wider use of sustainable coppers, we are working on technological development to increase the recycled raw materials ratio (input ratio of raw materials or content ratio in products) to 50% or more by 2040. To this end, it is essential to enhance our system for collecting and processing recycled raw materials. Here, we will not only strengthen the supply chain through capital investment and M&A, but also form Green Enabling Partnerships with companies, local governments, universities, and research institutions who work together to promote sustainable copper. Through these partnerships, we engage in product and scrap collection, raw materials reuse, and joint technology development (see page 26).

Electric vehicles (EVs) are expected to become widespread as part of a decarbonized society. This will increase demand for lithium, cobalt, and nickel used in lithium-ion batteries (LiBs) in EVs. There are also concerns about geopolitical risks and rising resource nationalism surrounding these resources. Future large-scale disposal of LiBs is also expected, requiring their efficient recycling.

The Group is working to develop technologies, conduct demonstration trials, and establish a resource recycling system throughout the supply chain with the aim of realizing closed-loop recycling to extract the aforementioned metals from automotive LiBs reaching end of life (EoL) in as automotive battery materials (see page 48).

Bench scale equipment for LiB recycling

Toward the goal of reducing our total inhouse CO₂ emissions in fiscal 2030 and fiscal 2050, we are working on four priority activities: (1) introduction of CO₂-free electricity, (2) generation of renewable energy, (3) promotion of zero energy loss activities, and (4) fuel switching and technology development toward decarbonization. As a result, our in-house CO₂ emissions in fiscal 2021 (total of Scope 1 and 2) were 892,000 t-CO₂.

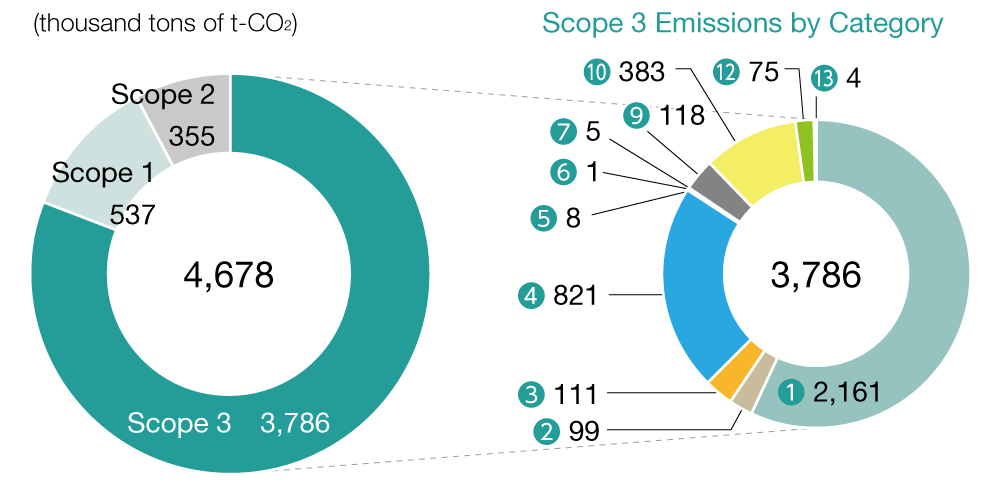

In addition to existing data for Scope 1 and 2 CO₂ emissions, in fiscal 2021 the Group began calculating indirect Scope 3 emissions in order to determine the overall CO₂ emissions generated by our operations and products. Through a Group-wide initiative centered on the Carbon Free Project, we have calculated emissions results for fiscal 2020 and fiscal 2021, while obtaining insights from outside experts. Going forward, we will study ways to improve calculation methods and accuracy for each category, as well as to establish and implement emission reduction targets.

Reduce Scope 1 and 2 CO₂ emissions

Scope 1 and 2 emissions are calculated for operating sites of high quantitative importance. Scope 3 emissions are calculated mainly for operating sites where production activities are conducted, and the scope of calculation is different for each category. Categories ❽,⓫,⓮, and ⓯ were not calculated because the Group has no relevant activities in these areas.

❶ Purchased goods and services ❷ Capital goods ❸ Fuel and energy-related activities not included in Scope 1 or 2 ❹ Upstream transportation and distribution ❺ Waste generated in operations ❻ Business travel ❼ Employee commuting ❽ Upstream leased assets ❾ Downstream transportation and distribution ❿ Processing of sold products ⓫ Use of sold products ⓬ End-of-life treatment of sold products ⓭ Downstream leased assets ⓮ Franchises ⓯ Investments

In our assumptions for fiscal 2050, emissions are expected to increase due to business expansion over the course of time. In response to this, we aim to achieve net-zero total in-house emissions (Scope 1 and 2) in fiscal 2050 by combining energy conservation, purchase and in-house generation of renewable energy, electrification and fuel switching, process modification, and carbon capture and recycling*, centered on the four priority activities we have already launched.

Through our recycling business, specifically the evolution of Green Hybrid Smelting, and supply of advanced technological materials and products, we contribute to the reduction of CO₂ emissions in society as a whole. We not only strive to reduce the Group’s CO₂ emissions to net zero, but also to reduce the CO₂ emissions of society as a whole.

Since approximately 60% of the Group’s in-house CO₂ emissions come from electricity, we began introducing CO₂-free electricity* in fiscal 2020. In January 2021, we began with the introduction of CO₂-free electricity at the Caserones Copper Mine, which accounted for approximately 20% of the Group’s total electricity consumption in 2018. Then, in fiscal 2022, the switch to CO₂-free electricity was completed at all major operating sites in Japan, except for some sites with contractual restrictions. We are also gradually switching electricity at our operating sites outside Japan.

Kurami Works

Isohara Works

Japan and other countries around the world where we operate have set targets to increase the percentage of renewable energy, but these targets are not quantitatively sufficient to achieve carbon neutrality for society as a whole. In addition to purchasing CO₂-free electricity, the Group is also committed to generating its own renewable energy.

To date, we have introduced hydroelectric, binary, and solar power generation facilities at our operating sites in Japan and overseas, and in February 2022, the first on-site solar power generation facility using a PPA* began operation at the Kakegawa Works of JX Metals Precision Technology Co., Ltd. In June 2022, the Isohara Works also started solar power generation via PPA, all of which is consumed in-house. Going forward, we will continue our efforts to expand the generation of renewable energy through various schemes.

| Kakinosawa Power Plant, JX Nippon Mining & Metals Corporation | Hydroelectric | 25,636 |

| Kakegawa Works of JX Metals Precision Technology Co., Ltd. | Solar | 979 |

| Shimoda Hot Springs Co., Ltd. | Binary | 340 |

| Nikko Metals Taiwan Co., Ltd. | Solar | 235 |

Solar power generation equipment installed on the roof of the Kakegawa Works

Solar power generation equipment installed on the roof of the Isohara Works

As a Group that operates in an electricity-intensive industry, we have been promoting energy conservation activities at every stage of our business activities for some time. However, we believe it is now necessary to promote zero energy loss activities from new angles in order to achieve net-zero CO₂ emissions. For example, we will take on the challenge of achieving zero energy loss by soliciting ideas from all Group employees, such as updating facilities with a focus on CO₂ reduction that goes beyond cost reduction focus, and fundamentally reviewing facility operation methods.

In order to promote such initiatives, we have established a 20 billion yen ESG investment quota in the current medium-term management plan. In the ESG investment quota, we have introduced internal carbon pricing (ICP), albeit on a limited basis, to financially support initiatives that contribute to ESG, including decarbonization.

In addition to electricity, our business processes use heavy oil, coke as a reducing agent, and other energy sources, and we are working to reduce CO₂ emissions from these sources. One candidate to achieve this is fuel switching. In the industry, technologies are being developed for new fuels such as hydrogen and ammonia, and we will also consider the use of these fuels.

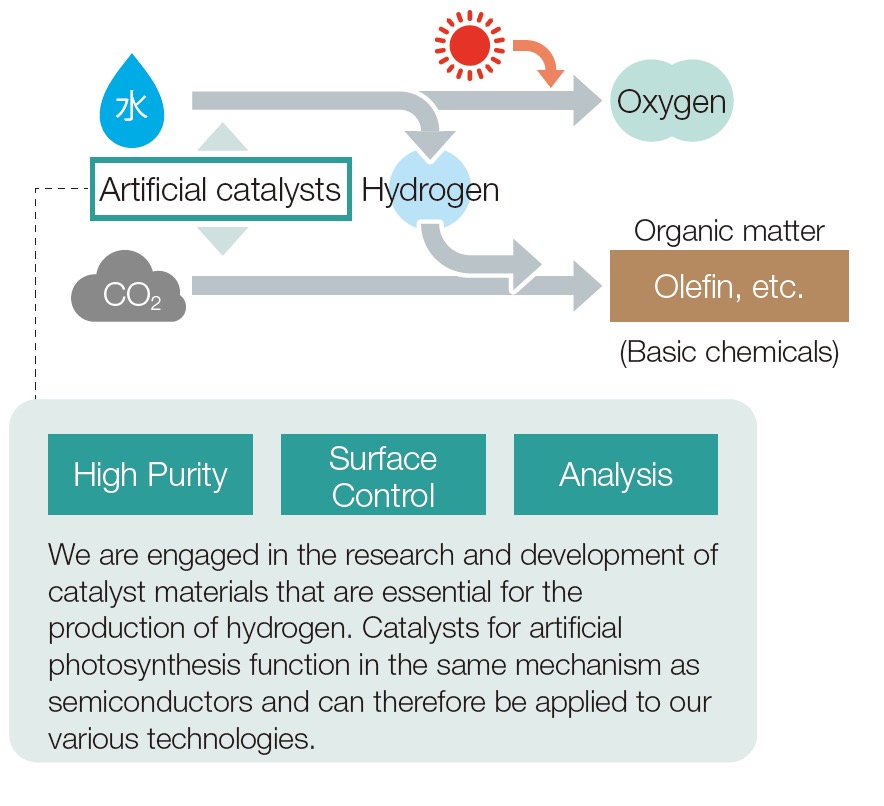

As an example of technological development, in February 2021 we announced our participation in the second phase of the Japan Technological Research Association of Artificial Photosynthetic Chemical Process (ARPChem). Artificial photosynthesis is a technology that uses solar energy and catalysts to break down water into hydrogen and oxygen, and then reacts the hydrogen with carbon dioxide to produce fuels and chemical raw materials. Global development of this technology is being pioneered by Japan.

As efforts to achieve carbon neutrality accelerate worldwide, interest is growing in this technology for generating green hydrogen*1. ARPChem, the association we have joined in this area, is a research consortium formed by the Ministry of Economy, Trade and Industry for the purpose of realizing artificial photosynthesis technology. During the first phase of activities conducted from 2012 to 2021, the association achieved a number of results such as the world’s first successful proof of concept of artificial photosynthesis. In the second phase of its activities, which will span the next 10 years, leading Japanese companies and research institutes*2 will bring together their specialized technologies to develop catalysts, develop hydrogen separation membranes, and verify safety, with a view to implementing these technologies in society.

By providing high purity metals such as tantalum and titanium, as well as a variety of technologies we have cultivated over time, we will also contribute to the development of catalysts that will help improve the conversion efficiency of solar energy.

* Prepared by JX Nippon Mining & Metals based on information on the website of the Agency for Natural Resources and Energy, Ministry of Economy, Trade and Industry

Test plant for artificial photosynthesis technology (courtesy of ARPChem)

The Group utilizes sustainable finance as part of its efforts to realize a decarbonized, circular economies. Sustainable finance is a method of guiding the promotion of solutions to environmental and social issues from a financial perspective. Our Group pioneered this method in its industry in order to reduce financing costs and expand business opportunities for continuous and systematic activities.

In recent years, as more emphasis has been placed on sustainable finance, a new financing method called transition-linked loans (TLL), which is different from conventional green bonds and sustainability-linked loans, has been attracting attention.

Traditional approaches have been predicated on the assumption that decarbonization would be achieved in line with the level of the Paris Agreement GHG reduction targets. However, concerns have arisen that GHG-intensive industries, where rapid decarbonization is challenging, would be delayed in receiving support. However, TLL allows for valuation of even a company’s long-term transition strategy itself, making it possible to raise funds for a wider range of projects.

Currently, expectations are growing for TLL to serve as a mechanism to support the implementation of long-term transition strategies by industries with significant GHG emissions, and rules are being developed in Japan and overseas to this end.

Under TLL, sustainability performance targets (SPTs) are set that are consistent with a company’s transition strategy, and incentives are provided such as linking interest rate terms to the achievement of these SPTs. In June 2022, the JX Nippon Mining & Metals Group became the first in the Japanese nonferrous metals industry to develop a transition-linked loan framework (TLLF). This frame-work was developed with the support of Mizuho Bank, Ltd. and has acquired a third-party assessment regarding its applicability to various principles and guidelines, including the Basic Guidelines on Climate Transition Finance established by the Ministry of Economy, Trade and Industry, the Ministry of the Environment, and the Financial Services Agency.

We have established two SPTs in our TLLF and linked the achievement of these SPTs to the interest rate terms of the TLL, thereby establishing a mechanism for us to commit to the implementation of our transition strategy.

Based on the framework we have formulated, the Company entered into a TLL agreement with Joyo Bank, Ltd. in June 2022. This is the first TLL project in the nonferrous industry in Japan, and will be used to cover the environ-mental costs of the New Hitachi-kita Factory (tentative name), a new production base for sputtering targets for semiconductors currently under construction in Hitachi City, Ibaraki Prefecture.

New Hitachi-kita Factory (tentative name)