Message From the President

Initial Public Offering

On March 19, 2025, JX Advanced Metals conducted an initial public offering on the Prime Market of the

Tokyo Stock Exchange. We are sincerely grateful to all of our stakeholders for their support and

cooperation.

The roots of JX Advanced Metals date back to 1905, when the company’s founder, Fusanosuke Kuhara, opened

the Hitachi Mine. Kuhara pushed for greater mechanization and modernization of the mine from its

inception. In just a few years, he built the Hitachi Mine into one of Japan’s leading copper mines and

laid the foundations of the Nissan Conglomerate, which fostered companies such as Hitachi, Ltd. under its

umbrella. In the intervening 120 years, we have evolved through repeated challenges and changes, becoming

the company we are today. Now, in addition to copper and other major base metals, we are a global player

as a supplier of advanced materials, including precious and minor metals. Our business operates on an

integrated supply chain, from resource procurement to recycling.

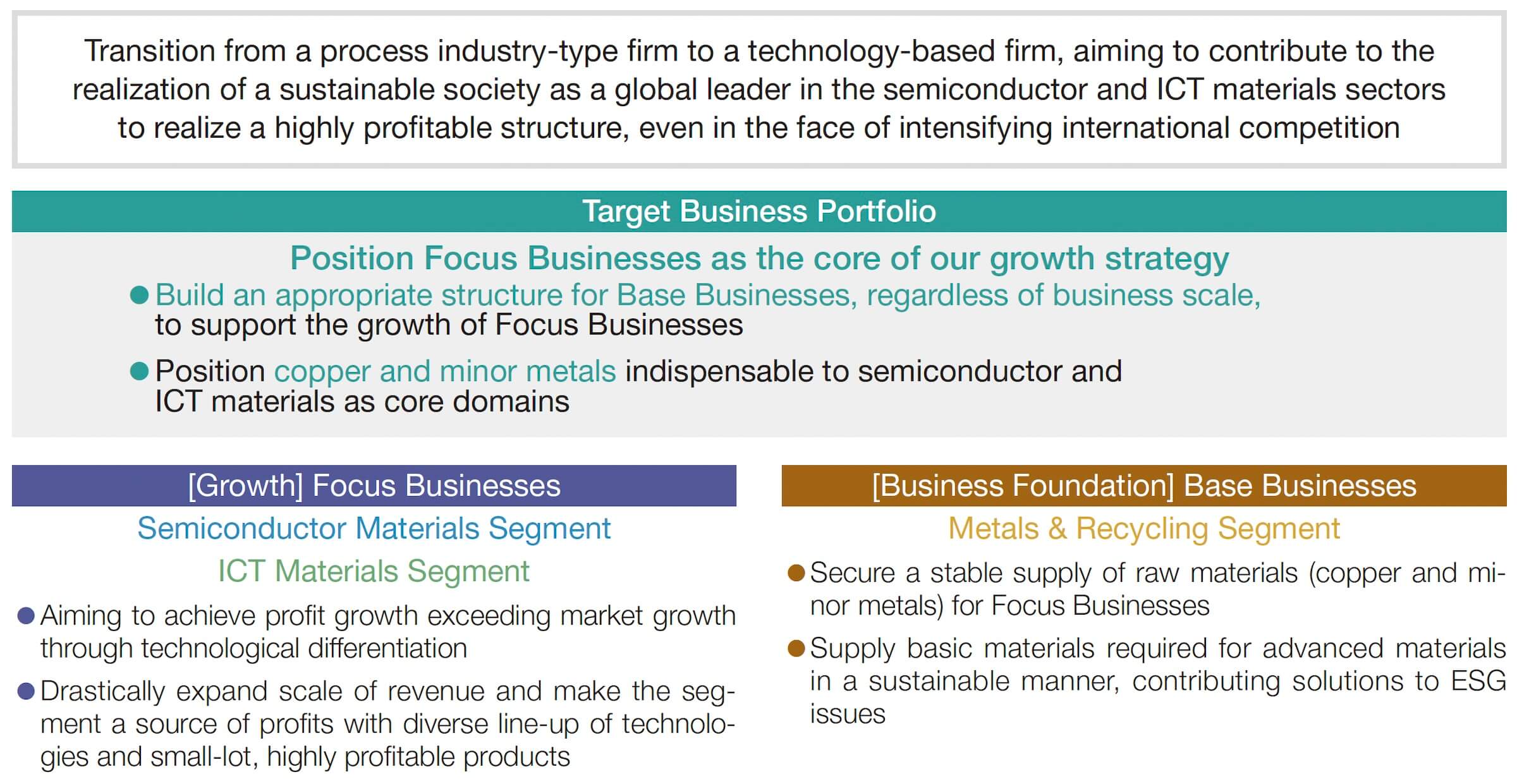

In June 2019, we created the Long-Term Vision 2040 (revised partially in May 2023), looking 20 years into

the future. This vision describes our basic policy to transition from a process industry-type firm to a

technology-based firm, aiming to contribute to the realization of a sustainable society as a global leader

in the semiconductor and ICT materials sectors to realize a highly profitable structure, even in the face

of intensifying international competition. Under this vision, we continue to enhance corporate value to

meet the expectations of you, our stakeholders. On behalf of our entire organization, I ask for your

ongoing support.

What We Learned From Interactions With Investors During the IPO Process

JX Advanced Metals Corporation announced preparations for an initial public offering in May 2023, beginning the process in earnest. We believe this IPO fostered a certain level of recognition in the market regarding our transition from a process industry-type firm focused on mineral resources, smelting and recycling into a technology-based firm focusing on semiconductor and ICT materials. At the same time, dialogues with investors during this global offering indicated at times that investors were not fully aware of JX Advanced Metals Corporation or our business model, partly because we had been under the umbrella of ENEOS Holdings.

We began a review of our business portfolio even before we began preparations for the IPO,

establishing our Focus Businesses—comprising the Semiconductor and ICT Materials segments that deal in

advanced materials—as the core of our growth strategy. What we call our Base Businesses consist of the

Metals & Recycling segment, which deals in mineral resources, smelting and recycling, serves as the

foundation supporting our Focus Businesses through the stable supply of raw materials.

Focus Businesses will survive global competition by differentiating through technology and achieving

profit growth that exceeds market growth. To this end, we must further develop products in areas where

we have strengths, while also creating and delivering new products. This process involves a great

number of moving parts to create new businesses, not to mention a system capable of withstanding

considerable trial and error. In this sense, we believe that the role of the Base Businesses in

providing a stable supply of materials and supporting growth is vitally important.

In conversations with investors prior to the IPO, I was sometimes asked whether we should concentrate

mainly on our Focus Businesses. However, in this era of heightened geopolitical risks, the stable

procurement of precious metals and minor metals essential for semiconductor materials are an important

issue, and one that is fundamental to the continuity of our business. From the perspective of

strengthening the supply chain, improving the conventional recovery of recycled materials is

increasingly important, as is exploring new mines for minor metals.

Meanwhile, other investors worried whether the scale of our Base Businesses was too large. JX Advanced

Metals recognizes that our copper production capacity far exceeds the demand of our Focus Businesses.

We have made steady progress in lightening assets through the sale of our interest in the Caserones

Copper Mine and the sale of shares in Pan Pacific Copper, a copper smelting subsidiary.

Through these dialogues, I learned firsthand about the intense speed demanded by investors. In this

context, the fact that quickly proved the synergies between Focus and Base Businesses, including the

execution of portfolio reform, gave us great confidence and helped us gain the trust of investors.

As we enhance our presence as a global leader in semiconductor and ICT materials, we must indicate

clearly the growth curve we intend to draw, and which businesses we intend to grow, in particular.

Even if valuation multiples remain constant, growth in the underlying business will increase corporate

value and, by extension, our share price. Making advancements in portfolio reform may result in an

increase in multiples, leading to even greater corporate value and higher share prices. Rising

geopolitical risks are a cause of uncertainty, including the tensions between the U.S. and China,

Russia’s invasion of Ukraine, and the destabilization of the Middle East. Amid these times, we intend

to communicate clearly the transformation of our business portfolio based on the Base Businesses and

Focus Businesses, where we have particular strengths. We will engage in dialogue with our stakeholders

and make decisions with a sense of urgency.

Creating a New Philosophical Framework to Embody What Must Not Change

The IPO reconfirmed to me the importance of fostering a better understanding of our business model and

enhancing our reputation in the market. I also reaffirmed the importance of every employee taking pride in

their work and in the Company, strengthening their engagement. We have consistently pursued proactive

branding initiatives, including television commercials and sponsorship agreements with professional sports

clubs. In addition to these initiatives, I understand that the significant media coverage surrounding our

IPO was a source of pride among employees whose families were impressed that they worked for such a

notable company. I feel strongly that we must share this reputation and pride across the entire

organization, encourage everyone to work together to achieve our long-term vision.

The IPO has been an opportunity to reiterate the ideas, attitude, and spirit of the JX Advanced Metals

Group. This spirit has been cultivated and passed down from generation to generation over our 120-year

history, and we redefined these concepts in September 2025, announcing the JX Advanced Metals Group’s

Philosophy, Our Purpose: Creating Value for a Brighter Future, Powered by technology,

passion, and innovation.

At the time of our founding, the sulfur dioxide generated during copper smelting at the Hitachi Mine was

causing serious smoke pollution. As a solution, then-founder Fusanosuke Kuhara decided to build what would

be the world’s tallest smokestack ("Giant Stack") at the time, bringing about a coexistence and

co-prosperity with the local community. Of course, this episode required the company’s technological

strengths, but it also proved a firm conviction rooted in a strong sense of responsibility and mission

toward business and society. At the same time, we proved our courage to make tough choices in attacking a

problem without fearing change or failure, engaging in discussions that transcended boundaries and seeking

human harmony, developing alongside society in a sustainable manner. The Giant Stack of the Hitachi Mine

stands as a symbol of our purpose in society. In the years since, JX Advanced Metals has continued to

boldly transform in response to the ever-changing needs of society—from copper to advanced materials

supporting electronic devices and recycling that fosters resource recycling. In every era, we have always

created value that leads to a better future.

This philosophy embodies our commitment to pursue value creation through a free and inventive mindset,

improving lives even as the world becomes increasingly uncertain and complex.

As stated in our Long-Term Vision, our focus is on the advanced materials business, mainly in

semiconductor and ICT materials. Working toward completing this business portfolio transformation, we face

challenging times and pioneering efforts, just as we did with the Giant Stack. I have high expectations

that the JX Advanced Metals Group’s Philosophy will be the driving force to achieve our Long-Term Vision,

as Group members share the unchanging aspiration that we have held since our founding and reflect this

commitment in their own actions.

We will continue to be a company that creates value and creates the future through technology, passion,

and innovative thinking, holding tightly to unchanging aspirations. I want every employee to have a sense

of ownership toward the company, believing they can make a difference, working together in unity toward

the next transformation and the creation of the future.

Progress Toward Medium- to Long-Term Business Targets For Achieving the Long-Term Vision

Based on our recent efforts and the business environment, in May 2024, we formulated Medium- to Long-Term

Business Targets toward achieving Long-Term Vision 2040. While we have made generally favorable progress

toward the targets for fiscal 2027, the external environment, triggered by U.S. tariff policy, is changing

more rapidly, and the future remains uncertain. Amid these circumstances, we believe we must allocate

resources from the perspective of a best owner, responding flexibly to changes in the market.

We have two major areas of focus for capital allocation toward achieving our medium- to long-term business

targets.

The first is to put Focus Businesses on a solid growth trajectory. As we continue to invest in growth in

semiconductor and ICT materials, we know we must create value through competitive advantage in advanced

materials technology, even as we recognize the downside risk of demand. We must raise the volume and make

capital investments in connection with our strong products, including sputtering targets and rolled

annealed copper foil, to firmly defend our current position. At the same time, we must develop products

that will become drivers of earnings in future generations. One example is indium phosphide (InP), a

crystalline material used in optical communications. The market for this material in use for generative AI

and data centers has grown 1.5 times in the last year, and is expected to continue to grow by 20% to 30%.

Demand is also on the rise for other high-quality materials, including sputtering targets for magnetic

materials used in HDDs for AI servers, titanium copper as a connecting material for high-speed

transmission, and tantalum powder as a capacitor material, where a stable power supply is critical. We

have already begun mass production of CVD-ALD, which is used as wiring materials for next-generation

semiconductors, and we have high expectations for significant growth. In these ways and more, we seek

sustainable growth by developing and delivering the advanced materials that support society.

The second is to strengthen the resilience of our Base Businesses. As I mentioned at the outset, Base

Businesses play an important role in our supply chain. However, as the business environment becomes even

more of a challenge, we realize surviving until 2040 will be difficult if we only maintain the status quo.

We must create higher added value. As part of our efforts, we pursue the recovery of minor and precious

metals through new investments in minor metal mines and expanded recycling in copper smelting, aiming to

maximize the value of these materials. Our efforts are valuable not only to our own company, but also to

society as a whole, since what we do links directly to the formation of a circular economy. To this end,

we must engage in ever-stronger cooperation with outside organizations.

In any case, we do not believe that we can reach 2040 under our current business portfolio. The

development of generative AI and IoT is a great opportunity for us to become a global leader in advanced

materials, and these technologies are our chance to act swiftly in changing business structures. As the

leader of our company, I recognize that my mission is to ensure the speedy evolution of our organization

and business structure, ensuring we will continue to provide value 20 years into the future.

The JX Advanced Metals Group Long-Term Vision 2040

Medium- to Long-term Business Targets

| Results (fiscal year ended March 31, 2023) |

Results (fiscal year ended March 31, 2024) |

Results (fiscal year ended March 31, 2025) |

Targets*1 (fiscal year ending March 31, 2028) | ||

|---|---|---|---|---|---|

| Operating profit | Consolidated | 72.9 billion yen | 86.2 billion yen | 112.5 billion yen | CAGR 10% to 15% (fiscal year ended March 31, 2024, to fiscal year ending March 31, 2028) |

| Focus Businesses | 55.7 billion yen | 27.3 billion yen | 51.8 billion yen | CAGR 35% to 40% (fiscal year ended March 31, 2024, to fiscal year ending March 31, 2028) |

|

| Operating margin | Consolidated | 4.5% | 5.7% | 15.7% | 12%〜17% |

| Focus Businesses | 15.0% | 8.8% | 12.5% | 15%〜20% | |

| Semiconductor Materials Segment | 23.2% | 21.4% | 18.0% | 25%〜30% | |

| ICT Materials Segment | 9.6% | 0.5% | 9.5% | 8%〜13% | |

| Profit composition ratio | Focus Businesses*2 | 66% | 26% | 41% | 67% or more |

| Semiconductor Materials Segment*2 | 40% | 25% | 21% | 45% or more | |

| ROE | 7.7% | 18.3% | 11.0% | 10% or more | |

| Net Debt/EBITDA*3 | 4.0x | 2.6x | 1.6x | Less than 1.5x | |

*1 The targets shown above are based on an assumed exchange rate for the fiscal year ending March 31,

2025, of 140 yen per U.S. dollar; an assumed exchange rate during and after the fiscal year ending March

31, 2026, of 135 yen per U.S. dollar; and an assumed copper price in and after the fiscal year ending March 31, 2025, of

380 cents per pound.

*2 This figure is calculated based on the operating income of the Focus Businesses (Semiconductor

Materials segment and ICT Materials segment) and the Base Businesses (Metals & Recycling segment),

excluding common costs. The operating income of the Focus Businesses is the simple sum of the operating income of the

Semiconductor Materials segment and the ICT Materials segment.

*3 This figure is calculated by dividing net debt (interest-bearing debts − cash and cash equivalents

(including ENEOS Holdings group short-term loans)) by EBITDA (operating income + depreciation expense).

Strengthening Sustainability Management and Governance

The JX Advanced Metals Group has identified six materialities for priority action toward achieving

Long-Term Vision 2040. We established KPIs for each materiality, measuring and assessing progress under

the Sustainability Committee.

The Group contributes to the creation of a sustainable society by rapidly delivering products and

technologies that support data society and IoT/AI society of the future. One of our materialities in

this context is to provide advanced materials that support lives and lifestyles.

In the context of this materiality, we may say that contribute to environmental

conservation and coexistence and co-prosperity with local communities have

been part of our company since the very beginning. As matters most closely related to our businesses,

these ideals are extremely important in our pursuit of long-term growth.

Another materiality is to create attractive workplaces. This is an important

materiality, since innovation through the power of people is a critical part of transforming into a

technology-based firm and maximizing corporate value. While it is important that every employee

improve their skills, the most important thing is how we develop people who think independently and

have the courage to lead innovation. To this end, we have taken on the challenge to create a culture

of praising our colleagues, creating a system that facilitates a fair evaluation of achievements. At

the same time, we strive to create workplaces offering a high level of psychological safety.

Lately, society has taken a keener interest in human rights violations in the supply chain. As a

company that deals in resources and materials globally, we take human rights risks in our supply chain

very seriously. We will continue to raise awareness of human rights in a broader sense, including

DE&I, while stepping up our efforts to emphasize respect for human rights more than ever.

In terms of strengthening governance with a view to becoming independent from the ENEOS Group, we have

taken time to improve systems, including appointing outside directors at the earliest stages. Among

other measures, we set the performance-linked ratio of executive compensation to 60% of the total,

demonstrating our resolve and responsibility. We also set a long-term performance-linked ratio to 60%

of total performance-linked compensation, which is equivalent to 36% of total executive compensation.

We incorporate non-financial factors into performance evaluations, as well, emphasizing perspectives

that include employee safety and increased employee engagement. Aside from these factors, I have come

to feel the importance of risk management even more strongly now that I serve as president. Our

company had been non-public for some time, operating under the umbrella of the ENEOS Group. During

that time, I must say that the level of risk management was by no means adequate. Now that we are a

publicly traded company on the stock exchange, we must improve systems to a level commensurate with

the required standards, and we believe that these efforts will lead directly to progress in our

materiality.

Six Materialities of the JX Advanced Metals Group

- Contribute to Environmental Conservation

- Provide Advanced Materials That Support Lives and Lifestyles

- Create Attractive Workplaces

- Respect for Human Rights

- Coexistence and Co-Prosperity With Local Communities

- Strengthen Governance

A Message to Stakeholders

JX Advanced Metals is supported by many stakeholders, including shareholders, investors, customers,

business partners, employees, and local communities. We want to be a company that continues to grow

together with these stakeholders.

We continue to listen sincerely and incorporate diverse feedback, including comments from investors,

opinions from customers, and information from the local community. We intend to grow together, drawing

strength from these diverse voices. While economic success is of course important, we do not want to

pursue monetary results alone: we want to be a company that is loved by our stakeholders,

understanding clearly the importance of the trust we have built.

I myself have a strong desire to see our company become an economically and socially indispensable

part of Japan. And I believe that if we are important to Japan, then we will be valuable in the global

market. To make this future come true, we must properly communicate our thoughts, values, and vision,

gaining the understanding and trust of our stakeholders.

We at JX Advanced Metals Corporation will continue to share a future of mutual growth with our

stakeholders, and we are committed to working diligently to this end. I look forward to your continued

support and encouragement.