Quick Guide to

JX Advanced Metals

JX Advanced Metals in Numbers

Profit Structure

- FY2023

Operating income - ¥81.1billion

(excluding inventory valuation,

including -¥18.7 billion in

non-allocated

corporate expenses)

- Semiconductor

materials

segment - ¥26.7billion

- ICT materials

segment - ¥1.8billion

- Metals &

Recycling

segment - ¥71.3billion

- Notes:

Semiconductor materials segment : Thin Film Materials Division, Tantalum and Niobium Division

ICT materials segment : Functional Materials Division, Tatsuta Electric Wire and Cable, Toho Titanium

Material & Recycling segment : Metals & Recycling Division, Resources development Division

- Notes: 1JX Advanced Metals discloses financial information through its holding company ENEOS Holdings, and the above operating income figures are for the Metals segment in ENEOS Holdings' consolidated financial results.

- Notes: 2ENEOS Holdings, Inc. has applied International Financial Reporting Standards (IFRS) from fiscal 2017.

Each Business in NumbersNote: As of the end of FY2023

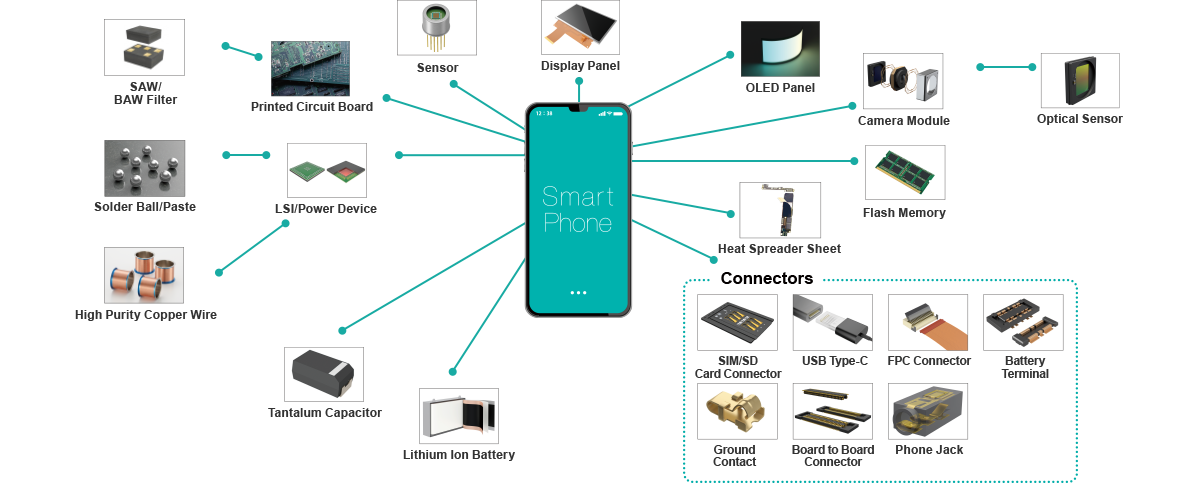

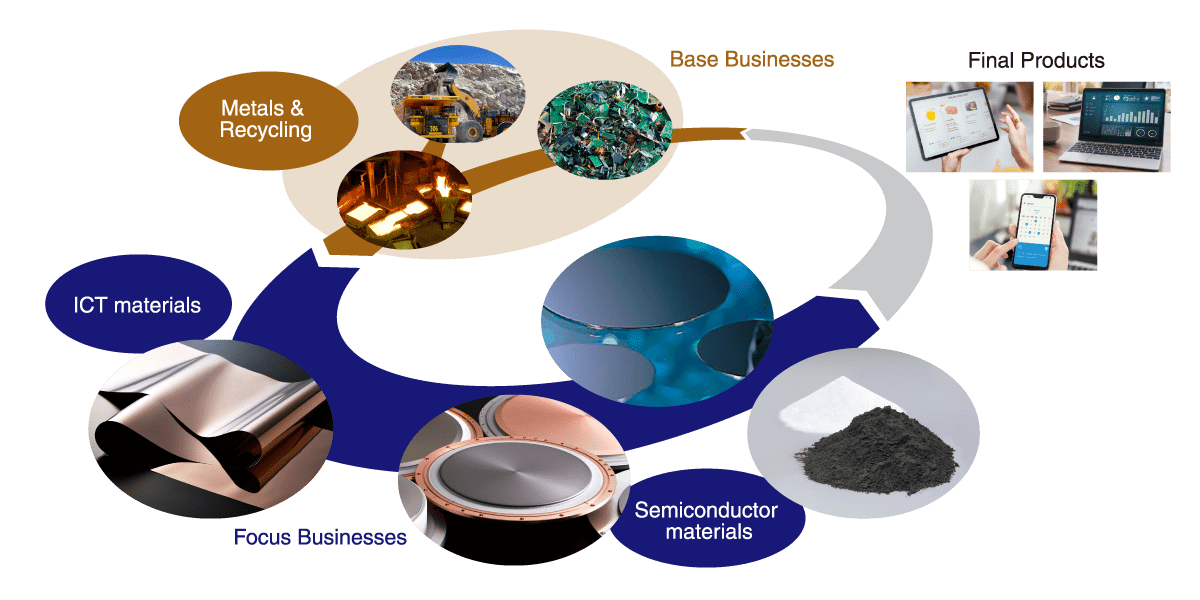

The Businesses of JX Advanced Metals

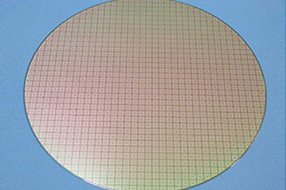

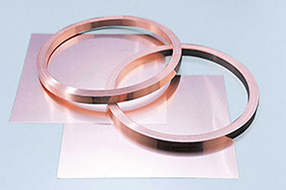

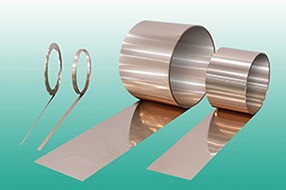

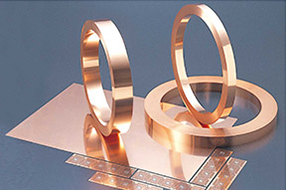

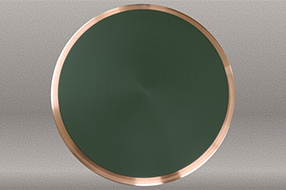

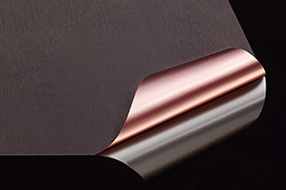

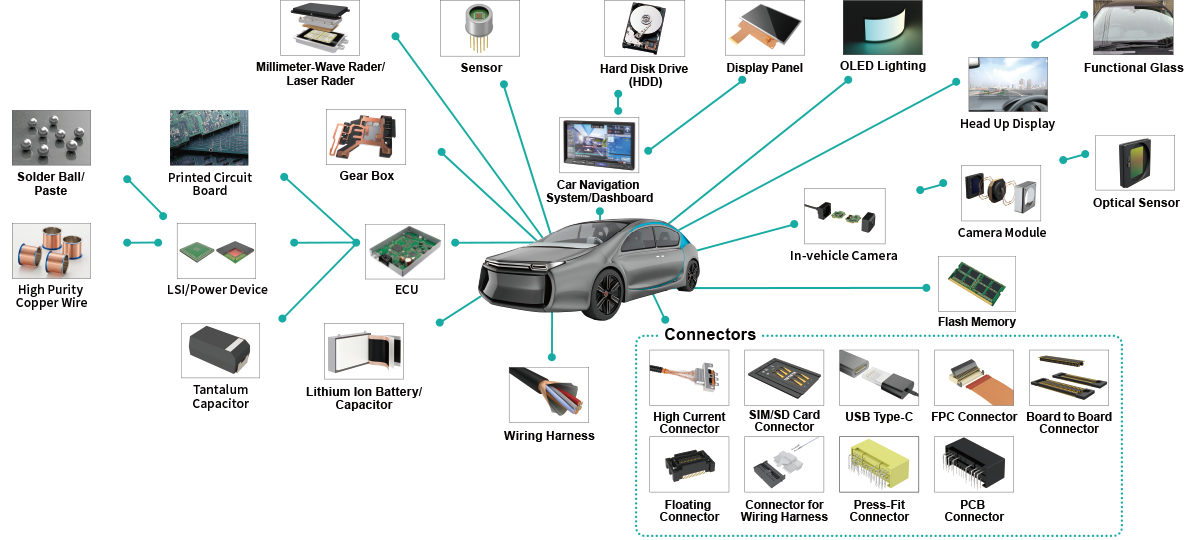

JX Advanced Metals conducts global business operations in the area of nonferrous metals, focusing primarily on copper and minor metals. These operations cover the full range from resource development, and smelting and refining, to the development and manufacture of advanced materials essential to societies in which the IoT and AI are progressing. The Group's operations also encompass recycling from end-of-life electronic equipment and devices.

Some of the Places You Will Find Us

Advanced materials and technologies of the JX Advanced Metals, supporting the future

Click on each image below to learn more about the advanced materials supplied by JX Advanced Metals.

The History of JX Advanced Metals

Since our founding in 1905, the Group has worked on creating new value, even while responding to various changes in the business environment. We are determined to continue our challenge, contributing to the development of a sustainable economy and society through creation and innovation in the areas of resources and materials.

Long-Term Vision

JX Advanced Metals Long-Term Vision 2040

- Shifting to a technology-based from a process industry-type firm

- Generating high and sustainable profits in fierce global business competition

- Contributing to the realization of sustainable society as a global leader in semiconductor/ICT materials

<Target portfolio>

Position the Focus Businesses as the core of our growth strategy

- Build appropriate structure for Base Businesses, regardless of business scale, to support growth of Focus Businesses

- Position copper and minor metals indispensable to semiconductor/ICT materials as core domains

【Growth】Focus Businesses

Semiconductor

materials segment

ICT materials

segment

- Aim to achieve profit growth exceeding market growth through technological differentiation

- Drastically expand scale of revenue and make it a source of profits with diverse line-up of technologies and small-lot, highly profitable products

【Business foundation】Base Businesses

Metals & Recycling segment

- Secure stable supply of raw materials (copper and minor metals) for Focus Businesses

- Sustainably supply basic materials required for advanced materials and contribute to resolution of ESG agenda