Decarbonization

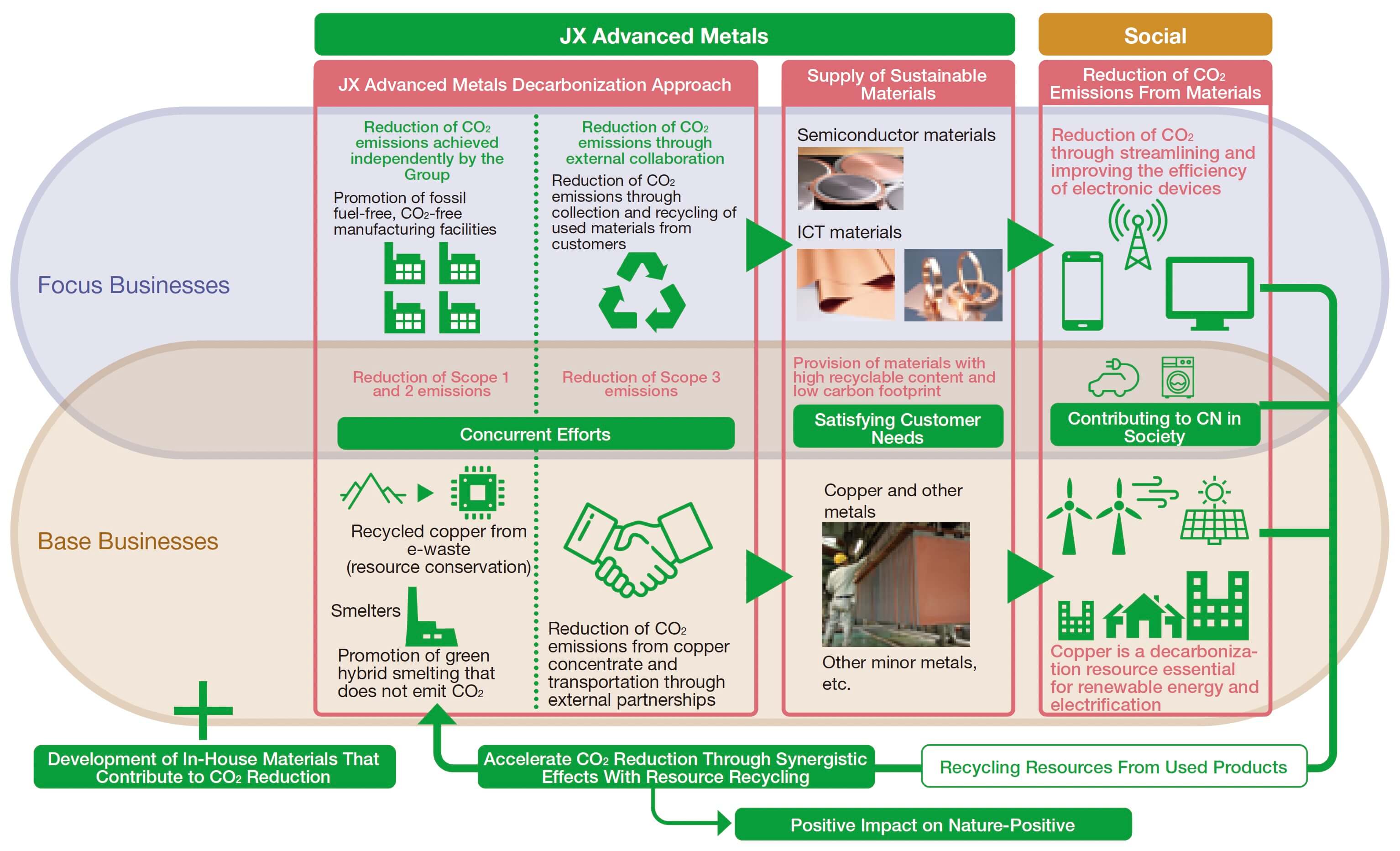

The JX Advanced Metals Group views climate change as an urgent issue that must be resolved on a global scale, and to contribute to the resolution of this issue, we set the ultimate goal of achieving net zero CO2 emissions and are further accelerating our efforts to achieve this goal.

Decarbonization Vision

Our group businesses are committed to resource recycling, particularly through expanding the use of recycled raw materials to reduce CO2 emissions, including Scope 3, across the supply chain. Our efforts here will allow us to focus on reducing the carbon footprint (CFP) of our products and meet customer needs while advancing both resource recycling and decarbonization. In June 2024, we developed a vision for decarbonization consisting of five initiatives.

Decarbonization Vision

We will implement decarbonization activities that simultaneously fulfill customer needs, provide integrated solutions to social challenges, and enhance the appeal of our products through the following five initiatives.

- 1.Reduction of CO2 emissions centered on resource recycling

- 2.Reduction of CO2 emissions throughout the entire supply chain through external collaboration

- 3.Simultaneous reduction of Scope 1, 2, and 3 emissions aimed at reducing the CFP of our products

- 4.Reduction of CO2 emissions by utilizing our own materials technology

- 5.Contribution to nature-positive through CO2 reduction and evaluation

Disclosure Based on the TCFD Recommendations

The JX Advanced Metals Group discloses information in accordance with the TCFD recommendations, using the disclosure framework for governance, risk management, metrics and targets, and strategy. We will continue strengthening our disclosures as climate-related reporting evolves, with developments such as the development and formulation of ISSB standards by the IFRS Foundation based on the TCFD.

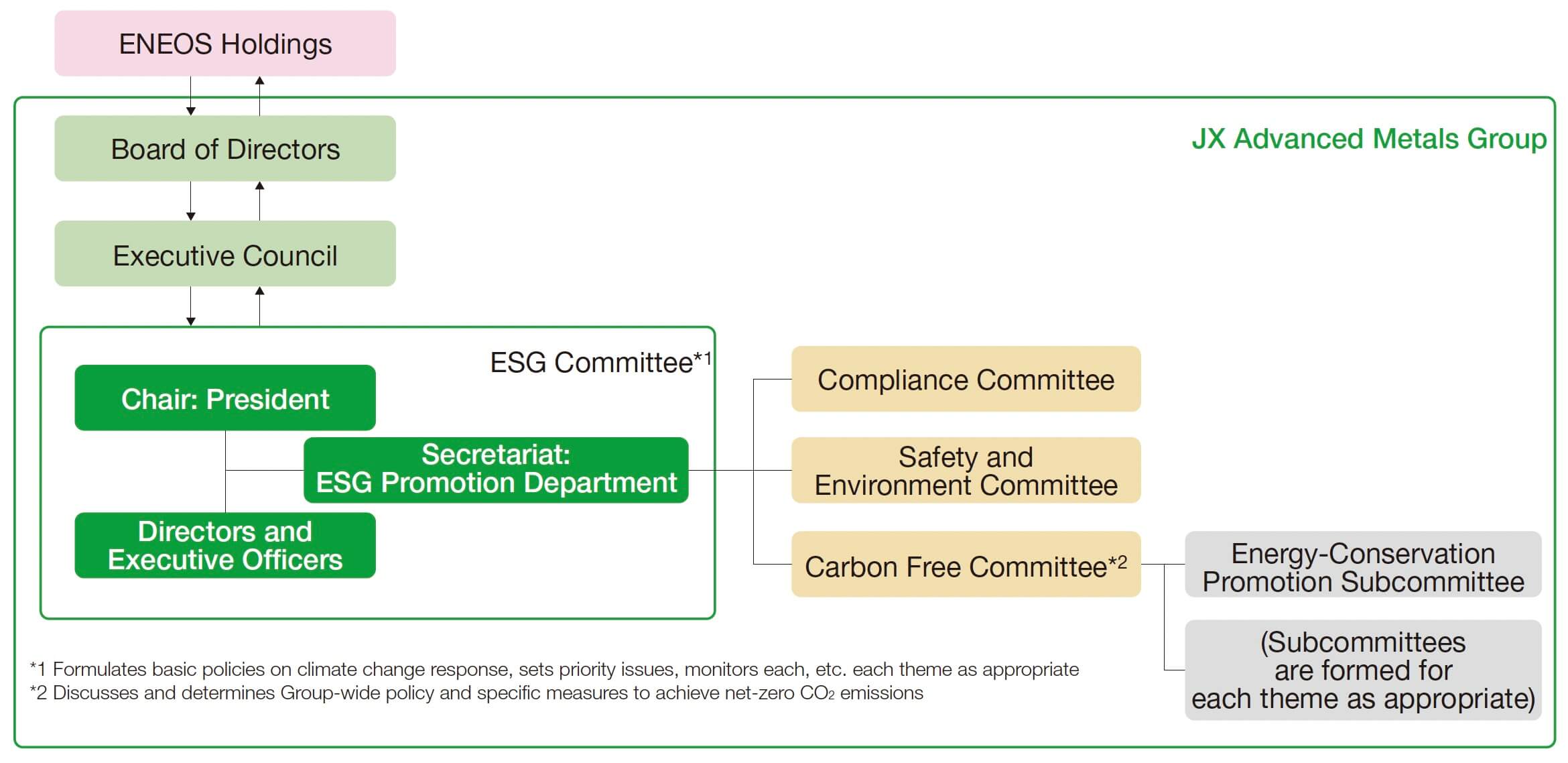

Governance

The Sustainability Committee, an advisory body to the president, is responsible for formulating basic policies regarding the Group's response to climate change, setting priority targets, and monitoring these targets. The Sustainability Committee is chaired by the president of the Company, with members from the Executive Council and with participation by outside directors as observers. This committee meets twice a year in principle. Matters deliberated and decided are discussed at and reported to the Executive Council and the Board of Directors as appropriate, depending on the content.

Risk Management

At the Group, the Sustainability Promotion Department works with each department to assess and identify risks and opportunities related to climate change, including scenario analysis, in accordance with the framework of the TCFD recommendations. The department recently collected and analyzed information for scenario analysis of a wide range of risk factors associated with climate change impacts, including regulations and business impacts. We also began to identify our own risks and opportunities related to climate change response, as well as medium- to long-term business strategy measures. The results of the analysis and the status of measure implementation are shared with management through the Sustainability Committee and other channels. Based on this system, each department takes action in these areas in cooperation with the Sustainability Promotion Department.

Systems for Climate Change Action

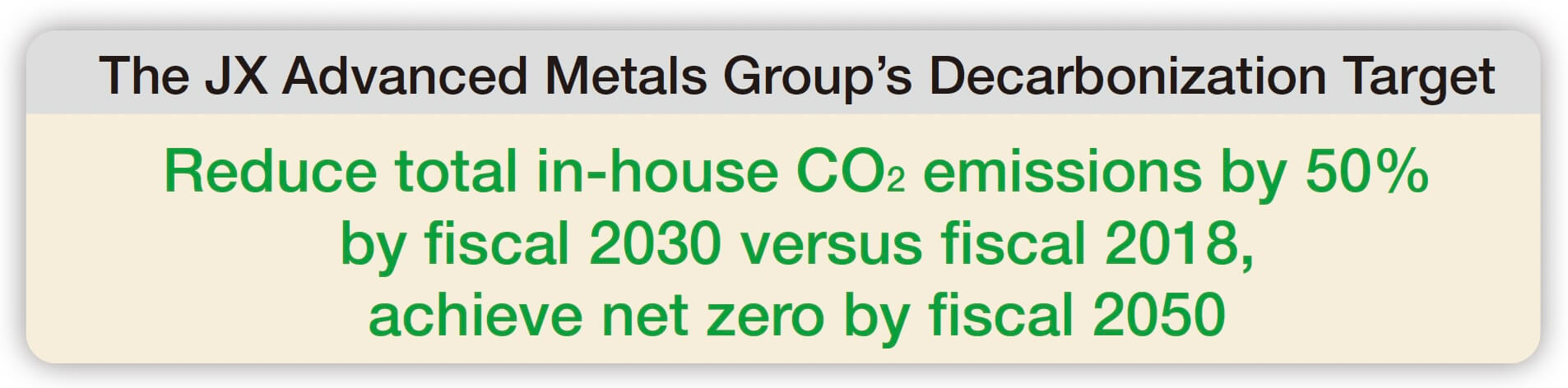

Metrics and Targets

The Group established in-house CO2 emissions (Scope 1 and 2) as a Group indicator of climate change and aims to achieve net-zero in-house CO2 emissions by fiscal 2050. We set an interim target of a 50% reduction by fiscal 2030 versus total in-house emissions in fiscal 2018, based on backcasting from our fiscal 2050 goal.

Conceptual Image of Net Zero CO2 Emissions in Fiscal 2050

- *Impact of Business Portfolio Changes includes CO2 emissions from the following entities, which were excluded from the Group’s scope between fiscal 2018 and the end of fiscal 2024.

SCM Minera Lumina Copper Chile; Hibi Smelter, Pan Pacific Copper Co., Ltd.; Keihin Kaseihin Center Co., Ltd; JX Metals Precision Technology Co., Ltd.; Nikko Fuji Precision (Wuxi) Co., Ltd. CO2 emissions from the following entities, which became Group companies between fiscal 2019 and the end of fiscal 2024, are not included in Impact of Business Portfolio Changes:

TATSUTA Electric Wire and Cable Co., Ltd.; Tokyo Denkai Co., Ltd.; eCycle Solutions Inc.; Osaka Alloying Works Co., Ltd.

Strategy

1. Recognition of Climate Change-Related Risks and Opportunities

[Analysis of climate change-related risks and opportunities]

In identifying the risks and opportunities that climate change poses to our Group and businesses, and in considering strategies to address risks and capture opportunities, we referenced the International Energy Agency's (IEA) World Energy Outlook (WEO). Furthermore, we analyzed global warming scenarios from the United Nations Intergovernmental Panel on Climate Change (IPCC).

[Identified risks and opportunities]

Assuming a transition to a decarbonized society in the wake of climate change, the Group's businesses will play a major role in shifting the power generation mix to renewable energy sources, transforming power use in ways such as electrification, and achieving social implementation of a circular economy. We also expect to see opportunities to increase product demand and enhance our offerings.

On the other hand, there are risks such as increased costs associated with the Group's own efforts to become carbon neutral on a global basis and lost opportunities due to delays in this process. In addition, there are potentially increased physical risks of extreme weather events damaging production facilities and logistics networks at operating sites in Japan and overseas, resulting in shutdowns.

Identified Risks and Opportunities

| Category | Impact | Risk/Opportunity | Measures |

|---|---|---|---|

|

Transition Risks |

Policies and Regulations | Increased costs to achieve net-zero CO2 emissions |

|

| Introduction and strengthening of carbon taxes, etc. in Japan and overseas |

|

||

| Reputation | Loss of opportunity due to delayed action toward decarbonization and environmental impact reduction |

|

|

|

Physical Risks |

Acute | Damage to facilities and shutdowns due to extreme weather events |

|

|

Opportunities |

Products | Increased demand for nonferrous metals needed for a decarbonized society (Resource and Metals Group) |

|

| Increased demand for high-end electronic materials (Advanced Materials Group) |

|

||

| Circular Economy | Realizing circular economy |

|

|

| Increased demand for and mandated recycling of automotive lithium ion batteries (LiBs) |

|

2. Scenario Analysis

Assuming a transition to a decarbonized society in the wake of climate change, the Group’s businesses will play a major role in shifting the power generation mix to renewable energy sources, transforming power use in ways such as electrification, and achieving social implementation of a circular economy. We also expect to see opportunities to increase product demand and enhance our offerings.

On the other hand, there are risks such as increased costs associated with the Group's own efforts to become carbon neutral on a global basis and lost opportunities due to delays in this process. In addition, there are potentially increased physical risks of extreme weather events damaging production facilities and logistics networks at operating sites in Japan and overseas, resulting in shutdowns.

1. Transition Risks

(1) Increased costs to achieve net-zero CO2 emissions

Electricity accounts for approximately 60% of our Group's total CO2 emissions (Scope 1 and 2), and we are switching to CO2-free electricity at our major operating sites in Japan and overseas. We are also considering measures to generate renewable energy on our own and to address energy sources other than electricity used in our manufacturing processes.

Although the initiatives needed to introduce these energy sources will involve additional costs, including capital investment, R&D expenses, and the price difference (premium) between CO2-free electricity and traditional electricity, we will steadily move toward decarbonization through the use of transition financing, a first in the nonferrous metals industry, and through cost reductions from energy-conservation activities.

(2) Introduction and strengthening of carbon taxes, etc. in Japan and overseas

Carbon taxes are being considered for introduction in Japan and overseas. If these or other systems are introduced, there is a risk of cost increases based on CO2 emissions. If a carbon tax is introduced, the annual cost increase is expected to be approximately 7 billion yen.

The Group has established a roadmap toward carbon neutrality and is steadily implementing various initiatives to reduce CO2 emissions, so we expect the cost burden to be relatively insignificant.

- *Fiscal 2018 Scope 1 and 2 emissions x 50% (2030 target): CO2e x USD50/t- CO2e x assumed exchange rate

(3) Loss of opportunity due to delayed action toward decarbonization and environmental impact reduction

If CO2 emission reductions do not proceed according to the roadmap or if other environmental impacts increase, there is a risk that the Group may suffer harm to our social credibility. In addition, delays in responding to climate change-related requests from customers could result in reduced sales opportunities.

The Group pursues steady decarbonization initiatives and responds to individual customer requests. We also develop technologies and make capital investments to reduce our carbon footprint (CFP) and increase the percentage of recycled raw materials in accordance with the Sustainable Copper Vision. Furthermore, we are building partnerships with external parties to achieve and disseminate the Sustainable Copper Vision.

2. Physical Risks

(1) Damage to facilities and shutdowns due to extreme weather events

Extreme weather conditions, including intensifying typhoons, increase the risk of domestic and international production sites, suppliers, and logistics networks being affected, leading to potential disruptions in normal operations. The Group has conducted analyses using hazard maps and other data at our major operating sites in Japan and confirmed that the risk of damage from extreme weather events is low. In addition, we have established BCPs, and conduct periodic training and reviews to promote the establishment of BCM. We believe that these measures will keep the impact on our business to relatively minor levels even if the risk of damage to facilities or shutdowns due to extreme weather events materializes.

3. Opportunities

(1) Increased demand for copper needed for a decarbonized society (Base Businesses)

Needs for renewable energy and electrification of mobility are expected to grow significantly toward the realization of a decarbonized society, and copper will be increasingly used in these areas. This growing demand is expected to provide opportunities for further sales and revenue growth for the Group. The Group is working to strengthen our business through portfolio reviews, and is taking various measures to increase the input recycled raw materials ratio and reduce our CFP in Green Hybrid Smelting, which utilizes both copper concentrate and recycled raw materials, to establish a stable supply system.

The supply of electrolytic copper and electronic materials with a high ratio of recycled raw materials and low CFP realized through these efforts will contribute not only to the realization of a resource-recycling society but also to the strengthening of our business competitiveness.

(2) Increased demand for high-end electronic materials (Focus Businesses)

In addressing climate change, it is essential to significantly improve energy use efficiency using technologies such as IoT, AI, and 5G/6G. Many high-end electronic materials are used in these fields, and demand for these materials is expected to continue to grow. The Group has a product lineup with a strong global market share in the electronic materials field, including sputtering targets and treated rolled copper foil for FPC.

Currently, we are constructing several new plants and increasing capacity to meet strong demand. In addition, we are working to construct a new plant in Hitachinaka City, Ibaraki Prefecture, and in Mesa City, Arizona, the U.S., in anticipation of further growth in demand. In addition to these capital investments, from a longer-term perspective, the Advanced Technology & Strategy Department is taking the lead in open innovation through industry-academia collaboration and investment in startups.

(3) Realizing circular economy

Though demand for copper will continue to grow over the long term as the world moves toward a decarbonized society, the supply of copper ore and recycled raw materials from existing mines is limited.

The Sustainable Copper Vision we have established aims to build a stable supply system to support growing copper demand through Green Hybrid Smelting that utilizes both copper ore and recycled raw materials. As one of our measures to evolve and gain wider use of sustainable coppers, we are working on technological development to increase the recycled raw materials ratio (input ratio of raw materials or content ratio in products) to 50% or more by 2040. To this end, it is essential to enhance our system for collecting and processing recycled raw materials. Here, we will not only strengthen the supply chain through capital investment and M&A, but also form Green Enabling Partnerships with companies, local governments, universities, and research institutions who work together to promote sustainable copper. Through these partnerships, we engage in product and scrap collection, raw materials reuse, and joint technology development.

By utilizing not only our own resources but also the global network and knowledge of our partners, we will strengthen the collection of recycled raw materials and collaborate with recyclers in Japan and overseas to reform and digitize recycling processes.

(4) Increased demand for and mandated recycling of automotive LiBs

Electric vehicles (EVs) are expected to become widespread as part of a decarbonized society. This will increase demand for lithium, cobalt, and nickel used in LiBs in EVs. There are also concerns about geopolitical risks and rising resource nationalism surrounding these resources. Future large-scale disposal of LiBs is also expected, requiring their efficient recycling.

The Group is working to develop technologies, conduct demonstration trials, and establish a resource recycling system throughout the supply chain with the aim of realizing closed-loop recycling to extract the aforementioned metals from automotive LiBs reaching end of life (EoL) and reuse them as automotive battery materials.

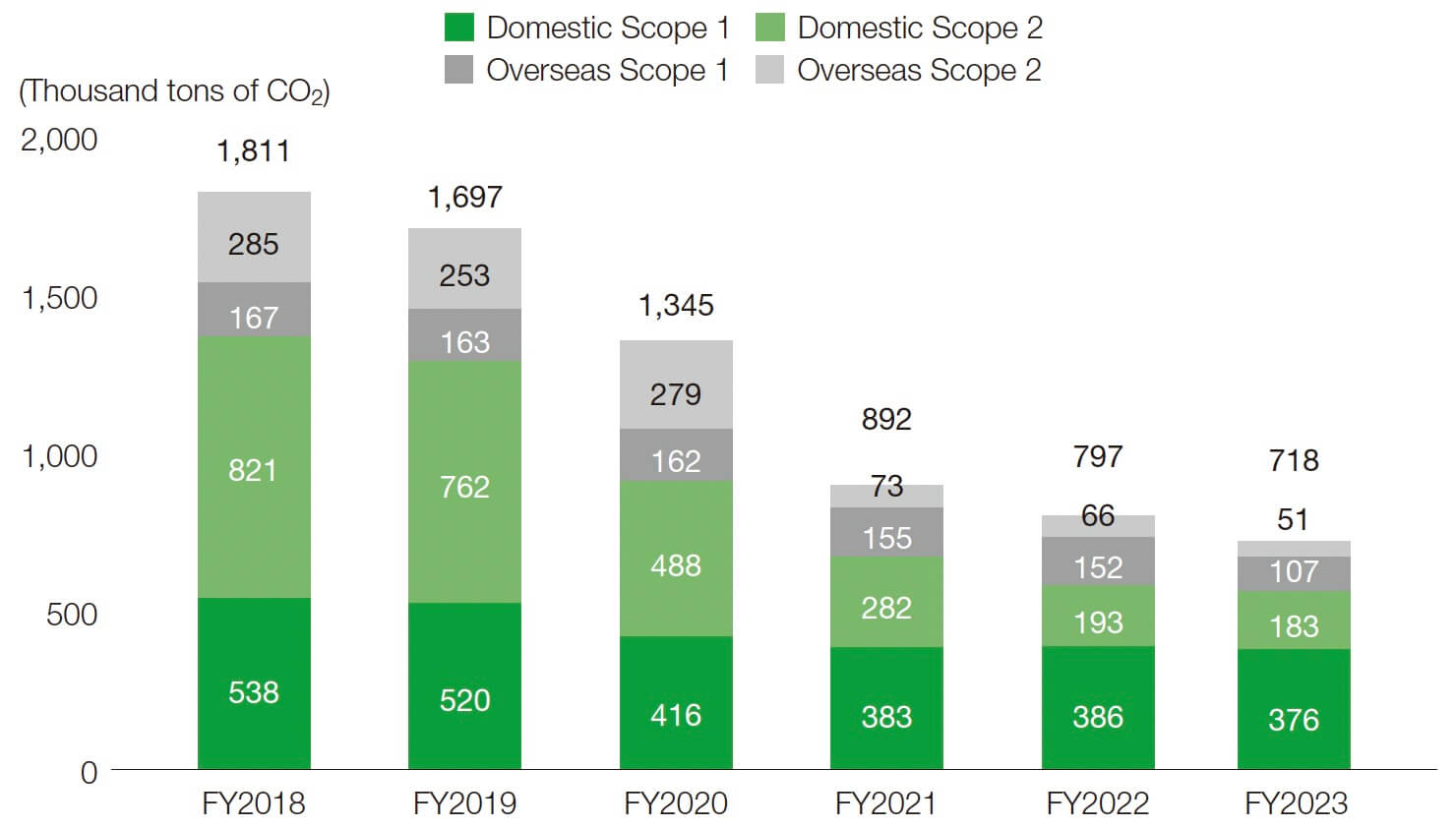

Current Status of CO2 Emissions

Reduction of CO2 Emissions (Scope 1 and 2)

JX Advanced Metals Group Scope 1 and 2 Emissions

Toward our goals of reducing our total in-house CO2 emissions by fiscal 2030 and fiscal 2050, we are working to introduce CO2-free electricity, generate renewable energy, pursue zero-energy loss activities, and switch to lower-carbon fuels while advancing technology development. Our in-house CO2 emissions in fiscal 2024 (total of Scope 1 and 2) were 597 thousand t-CO2.

Calculation of CO2 Emissions (Scope 3)

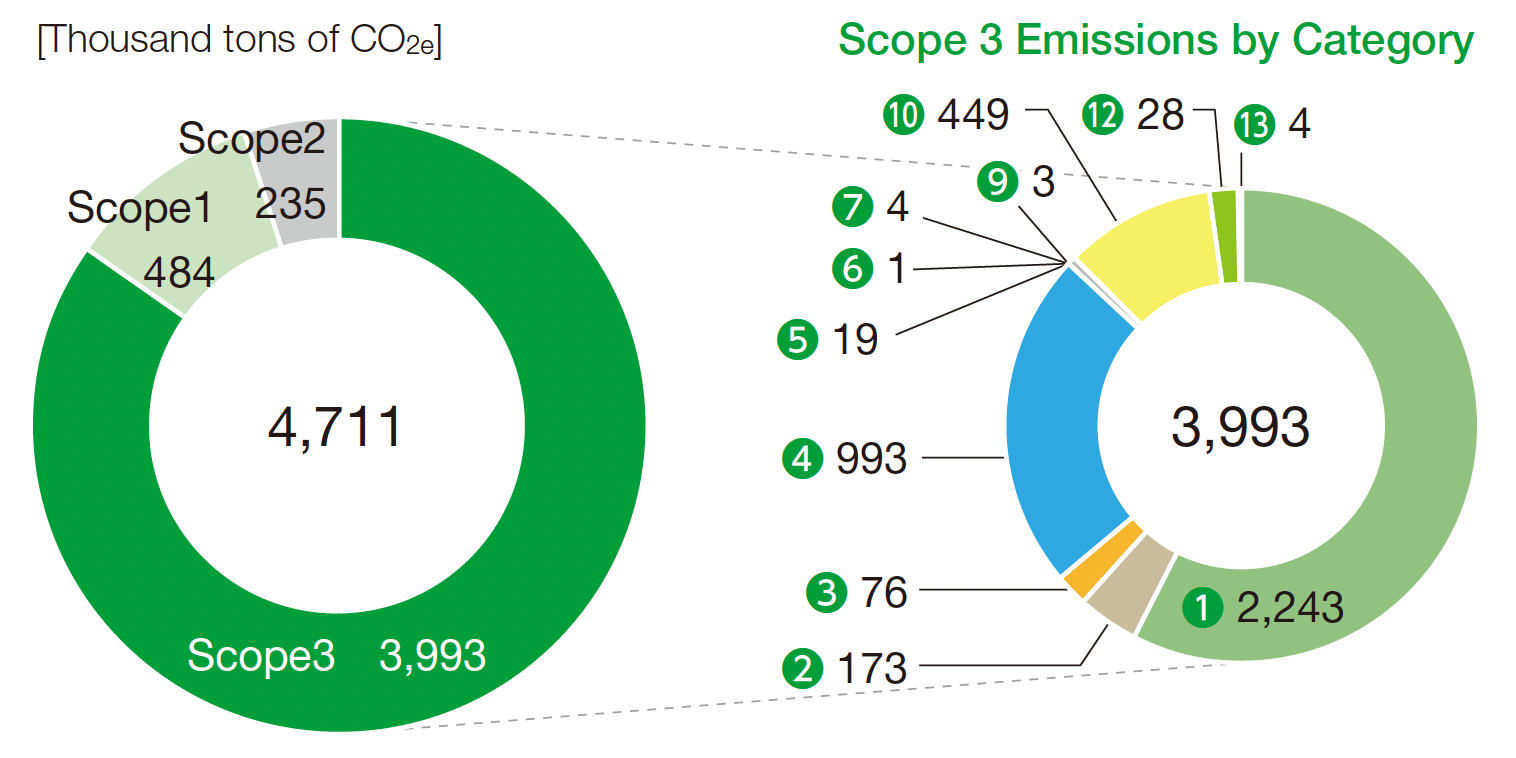

Scope 1, 2, and 3 Emissions (FY2024 Results)

Categories❽,⓫,⓮,and⓯ were not calculated because the Group has no relevant activities in these areas.

- * For details on the calculation criteria for Scope 3, please refer to this page.

In addition to existing data for Scope 1 and 2 CO2 emissions, in fiscal 2021, the Group began calculating indirect Scope 3 emissions in order to determine the overall CO2 emissions generated by our operations and products. We are currently studying ways to improve calculation methods and accuracy for each category, as well as to establish and implement the emission reduction roadmap.

Scope 3 Categories

❶Purchased goods and services ❷Capital goods ❸Fuel-and energy-related activities not included in Scope 1 or 2 ❹Upstream transportation and distribution ❺Waste generated in operations ❻Business travel ❼Employee commuting ❽Upstream leased assets ❾Downstream transportation and distribution ❿Processing of sold products ⓫Use of sold products ⓬End-of-life treatment of sold products ⓭Down-stream leased assets ⓮Franchises ⓯Investments

Examples of Initiatives Toward Decarbonization

- Initiative(1) Activities of the Carbon Free Committee

- Initiative(2) Initiatives for Decarbonized Electricity

- Initiatives(3) Implementation of Zero Energy Loss Activities

- Initiative(4) Fuel Switching and Technology Development Toward Decarbonization

- Initiative(5) Developing a Transition-Linked Loan Framework as the First Such Endeavor in the Japanese Nonferrous Metals Industry

- Initiative(6) Participation in the GX League

Initiative(1)

Activities of the Carbon Free Committee■ Initiatives at Each Site to Achieve Our Decarbonization Vision

| Operating sites | Initiative [Progress] |

|---|---|

| Isohara Works | Electrification of steam generation [Consideration of equipment specifications and installation space requirements] |

| Kurami Works | Hydrogen and ammonia alternatives to city gas [Consideration of collaboration with external organizations and companies] |

| JX Metals Smelting Co., Ltd., Saganoseki Smelter & Refinery, Ibaraki Office (Hitachi Area) | CO2 capture and utilization (CCUS) [Consideration of collaborators for CO2 concentration measurement and capture, equipment specifications, and installation space requirements] |

| Kasuga Mines Co., Ltd. | Decarbonization of heavy equipment [Research on electric heavy equipment and testing of biofuels as an alternative to diesel] |

The Carbon Free Committee was established in fiscal 2022 as an organization to discuss and decide on company-wide policies and specific measures to achieve net zero CO2 emissions. The committee is led by the Sustainability Promotion Department and includes executives from each business division and production site, the Technology Group, and management from each Group company. Since its establishment, the committee has been considering decarbonization and resource recycling measures that contribute to enhancing our business competitiveness and added value from a comprehensive and strategic perspective toward achieving CO2 net zero. We are accelerating our efforts with a focus on the early realization of Carbon-Neutral Plants (achieving net zero for Scope 1 and Scope 2 emissions at production sites). Specifically, we are considering the electrification of steam boilers, utilization of hydrogen and ammonia as alternatives to city gas, early introduction of biofuels, and introduction of CO2 capture and utilization facilities.

In addition to these measures, the Carbon Free Committee is also working to reduce Scope 3 CO2 emissions to realize the JX Advanced Metals Group's Decarbonization Vision.

Initiative(2)

Initiatives for Decarbonized Electricity■ Renewable Energy Facilities and Total Electricity Generation (Fiscal 2024)

(Thousands of kWh)

| Site | Method | Generated |

|---|---|---|

| Kakinosawa Power Plant, JX Advanced Metals Corporation | Hydroelectric | 23,865 |

| Kurami Works (Off-Site), JX Advanced Metals Corporation | Solar | 8,891 |

| Isohara Works | Solar | 285 |

| Wakamatsu Plant, Toho Titanium Co., Ltd. | Solar | 1,791 |

| Nikko Metals Taiwan Co., Ltd. | Solar | 237 |

| Nippon Mining & Metals (Suzhou) Co., Ltd. | Solar | 68 |

| JX Metals Korea Co., Ltd. | Solar | 140 |

| JX Nippon Coil Center Co., Ltd. | Solar | 269 |

| JX Metals Tomakomai Chemical Co., Ltd. | Solar | 1,526 |

| Materials Service Complex (Thailand) Co., Ltd. | Solar | 106 |

- *Top 10 facilities only

Since approximately 60% of the Group's in-house CO2 emissions (Scope 1 and 2) come from electricity, we began introducing CO2-free electricity*1 in fiscal 2020.

In fiscal 2024, many of our sites in Japan and overseas completed or continued switching to CO2-free electricity.

To date, we have introduced hydroelectric, and solar power generation facilities at our operating sites in Japan and overseas. In April 2023, we implemented solar power generation using an off-site PPA model*2 for Kurami Works. This is the first time for the Group to adopt an off-site model outside a plant site. We expect power generation on the order of 9,000 kW (solar panel basis), making it one of the largest single-facility, off-site PPA model solar power generation systems in Japan.

In April 2024, we launched the largest on-site PPA solar power generation system within the Group at JX Metals Tomakomai Chemical Co., Ltd. The company is in the recycling business and contributes to resource recycling by using renewable energy created through the effective utilization of idle land at its business sites.

- *1CO2-free electricity: Electricity derived from virtually non-fossil-fuel power sources, etc., that does not result in CO2 emissions, with an adjusted CO2 emission factor of 0.00 t- CO2/kWh. This may include nuclear power as well as renewable energy such as hydro, wind, solar, etc.

- *2PPA: Power Purchase Agreement. A system in which a company or other facility owner leases its premise, roof, or other space, a power company installs a solar power generation system, and the facility owner uses the power generated and pays a fee

Initiatives(3)

Implementation of Zero Energy Loss Activities

As a Group that operates electricity-intensive businesses, we have been implementing energy conservation activities at every stage of our business activities for some time. However, we believe it is now necessary to implement zero energy loss activities from new angles to achieve net-zero CO2 emissions. For example, the Energy-Conservation Promotion Sub-committee is leading initiatives to achieve zero energy loss, such as updating facilities with a focus on CO2 reduction that goes beyond cost reduction, and fundamentally reviewing facility operation methods.

In July 2025, we built a comprehensive office building at the Chigasaki Plant of Toho Titanium as part of the Group company's renewal plan. The building is the first in our Group, and also the first in Chigasaki City, to receive Net Zero Energy Building (ZEB) certification. The office building combines advanced energy-saving and energy-generation technologies to maintain a comfortable indoor environment while keeping annual primary energy use at net zero or below.

Initiative(4)

Fuel Switching and Technology Development Toward Decarbonization

In addition to electricity, our business processes use heavy oil, coke as a reducing agent, and other energy sources, and we are working to reduce CO2 emissions from these sources. One option to achieve this is fuel switching. Industry is developing technologies for new fuels such as hydrogen and ammonia, and we are also considering their utilization within the Company.

In May 2024, we launched a demonstration test of mixing biofuel*1 with fuel (diesel oil) for in-house power generation equipment used at Kasuga Mines Co., Ltd. Based on the results of the demonstration test, we will consider applying the technology to heavy machinery used by the company and operating with 100% biofuel. The silicate ore produced by Kasuga Mines is used at the JX Metals Smelting Co., Ltd. Saganoseki Smelter & Refinery. The use of this biofuel not only reduces the company's CO2 emissions, but also contributes to reducing the carbon footprint (CFP) of electrolytic copper.

In addition, Kasuga Mines has started trial cultivation of plants that serve as raw materials for biofuel, rather than only using biofuel.

- *1In this demonstration test, approximately 20% hydrogenated vegetable oil (HVO) was mixed with diesel oil

Initiative(5)

Developing a Transition-Linked Loan Framework as the First Such Endeavor in the Japanese Nonferrous Metals Industry

Currently, expectations are growing for transition-linked loan frameworks (TLL) to serve as a mechanism to support the implementation of long-term transition strategies by industries with significant GHG emissions, and rules are being developed in Japan and overseas to this end.

In June 2022, the JX Advanced Metals Group became the first in the Japanese non-ferrous metals industry to develop a transition-linked loan framework (TLLF) with support from Mizuho Bank. Based on the framework we have formulated, the Company entered into a TLL agreement with Joyo Bank, Ltd. in June 2022. This is the first TLL project in the Japanese non-ferrous metals industry.

Initiative(6)

Participation in the GX League

The GX League, led by the Ministry of Economy, Trade and Industry (METI), is a framework for industry, government, and academia to collaborate in the challenge of Green Transformation (GX) with a view to achieving carbon neutrality by 2050 and reforming Japan's entire economic and social system. We participate in GX activities, and we expressed our support for the GX League Basic Concept. We announced our participation in Phase 1, covering fiscal 2023 to fiscal 2025.

Phase 1 will include proof-of-concept tests and dialogues regarding three initiatives: (1) A platform for the future vision, (2) A platform for market creation and rulemaking, and (3) A platform for carbon credit exchange. JX Advanced Metals will participate actively in discussions and information exchange toward the achievement of GX.